By Cloudbeds

As the lodging industry starts making strides down the road to recovery, industry professionals are eagerly watching the latest data to learn anything we can about the ways in which the pandemic has shifted demand patterns for vacation rentals and hotels.

Are hotels benefiting from brand recognition and standardized cleaning procedures to edge out vacation rentals? Or are vacation rentals more in demand because they offer better opportunities for social distancing?

To find out, Cloudbeds enlisted the help of leading benchmarking and data insights providers STR and AirDNA. Together, we put hotel recovery data up against vacation rental data in a webinar with AirDNA’s Scott Shatford and STR’s Robin Rossmann. The data shows a clear shift in demand across geographies, price points, and property types.

How long will these demand shifts last? And which property type will come out stronger after the coronavirus health crisis? Here, we’ll share a few key highlights.

The analysis includes hotel and short-term rentals data from 2019 to June 27th 2020 in 27 markets globally, including 12 regional destination markets and 15 urban markets. All revenue is in USD.

For the full analysis and stats, including a more in-depth breakdown of different regions, check out the webinar replay here: CloudTalks Special – Hotel vs. Vacation Rental Recovery.

Location

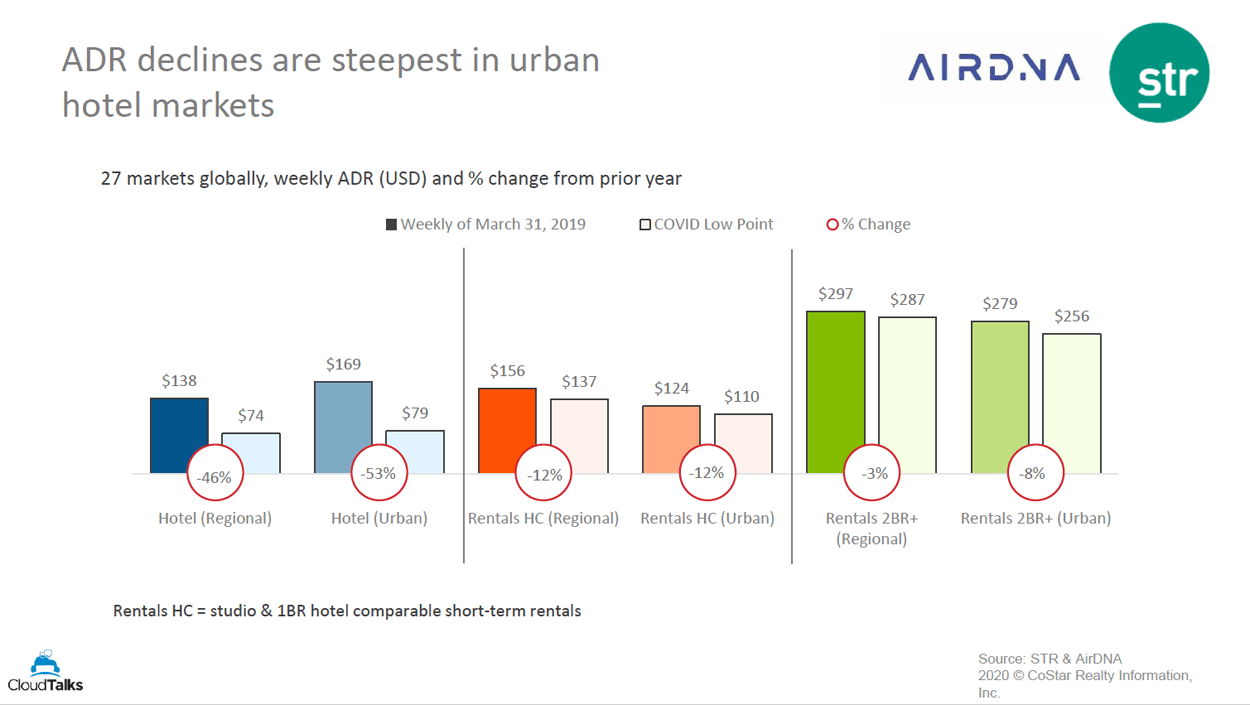

Location is proving to be one of the major determinants of demand for both hotels and vacation rentals. The data shows that urban markets are suffering the most. As weekend city getaways, group business, and international travel have dropped, city hotels have faced the steepest ADR declines:

At the same time, locals looking to escape the city are driving high demand to smaller holiday destinations near urban markets. As demand shifts towards drive markets, or markets within about 100 miles from a city center, these regional areas are rebounding quicker than urban markets for both hotels and vacation rentals.

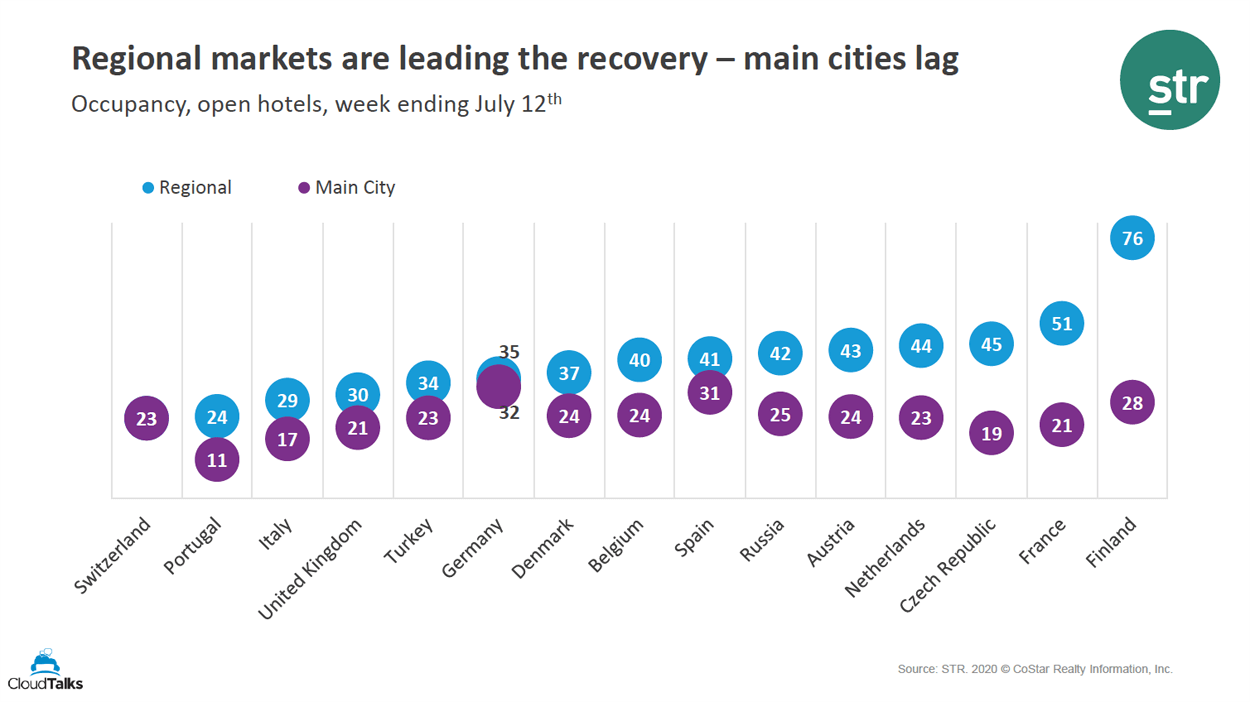

The trend towards stronger regional markets is global. This category leads the recovery, with main cities lagging behind on occupancy throughout Europe and other regions as well.

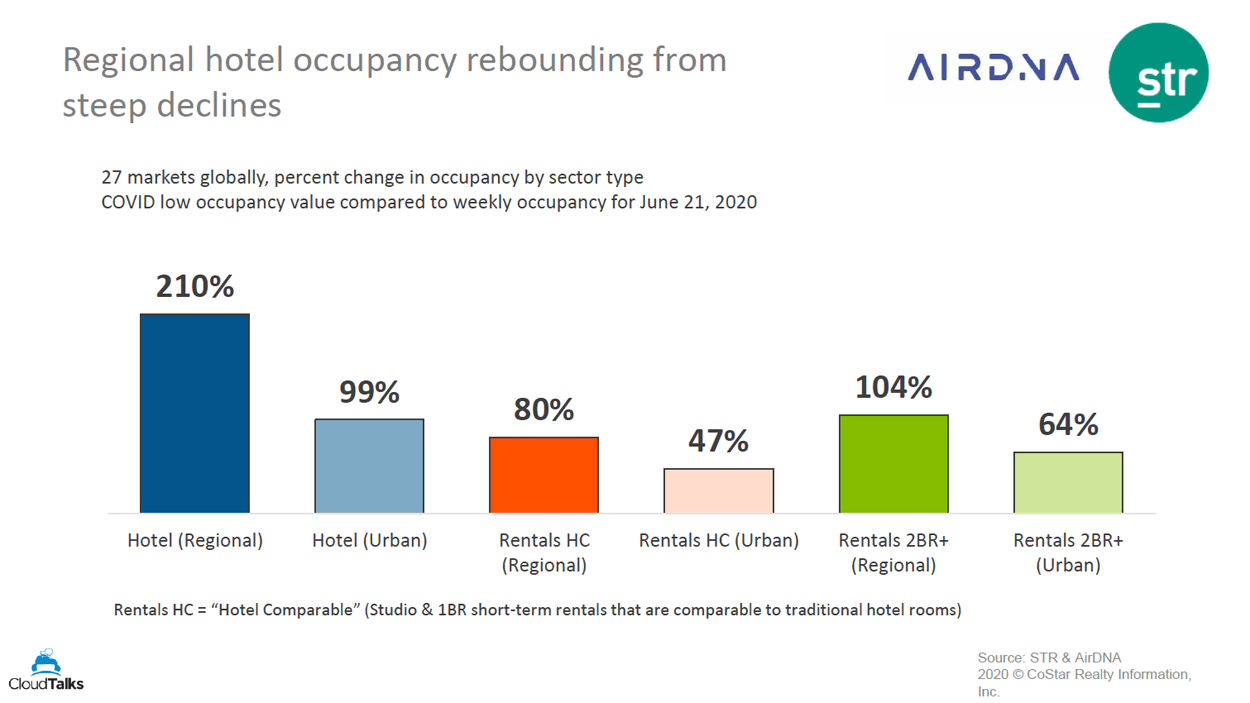

So how big is the rebound for regional markets? Regional hotels saw a jump of 210% in occupancy while urban hotels saw “only” a 99% increase from their lowest point in the COVID-19 pandemic (around March 2020) to data from June 21, 2020.

It’s important to note that even though hotel occupancy growth is leading, it’s coming from a lower base due to steeper declines. This is the percentage growth and occupancy based on that low point, and hotels have come back stronger because they declined further, whereas short-term rentals didn’t decline as far. Still, in both cases, we can see that regional markets are recovering the quickest.

Price Point/ADR

With families and small groups preferring a more contactless, low-traffic environment, larger holiday rentals that are better equipped to provide that type of experience command premium rates due to increased demand. Meanwhile, the smaller, lower-priced “hotel comparable” vacation rentals that usually serve budget travelers, like studios and one-bedroom apartments, are experiencing low demand.

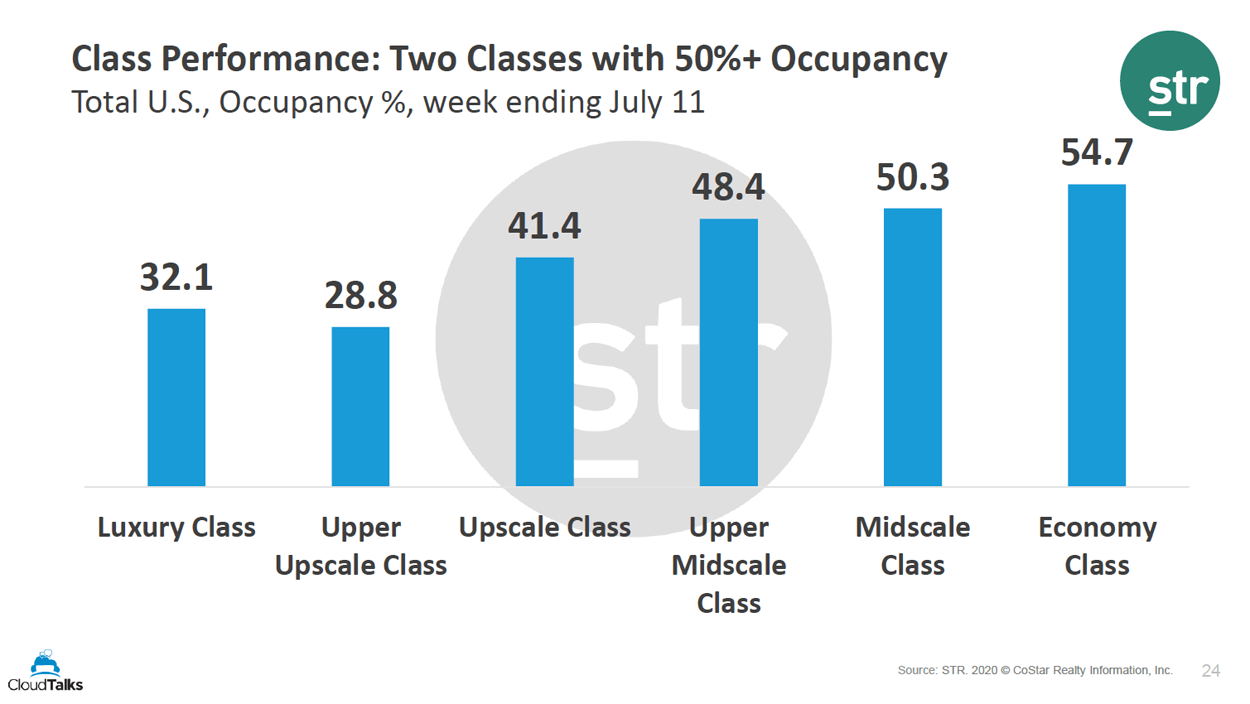

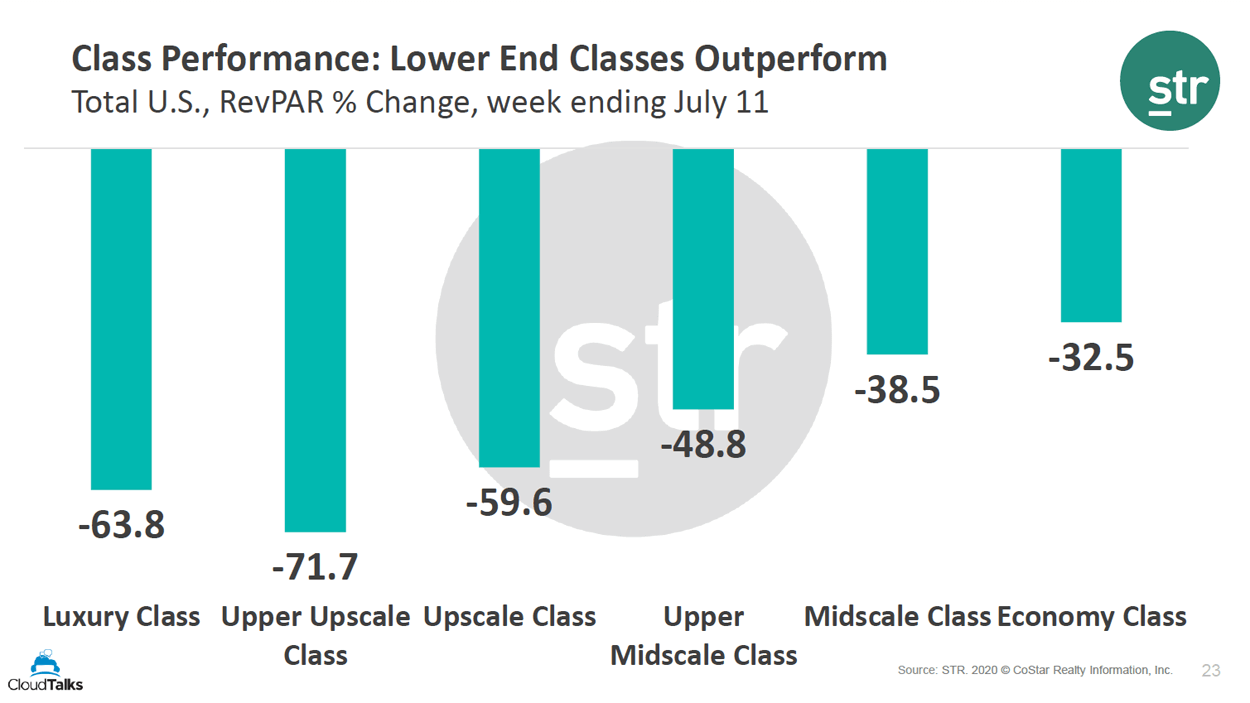

However, the opposite has proved true in the hotel sphere as budget hotels have been more resilient, dramatically outperforming higher-end properties in RevPAR and occupancy. This is probably due to the boost in regional travel and summer road trips that are bringing travelers to areas with fewer upscale properties where economy and midscale hotels are most popular.

Another factor that may have contributed to hotel prices dropping so low is that hotels typically have more sophisticated revenue management strategies, causing them to change prices, often driving them down in times like these, to keep their rates competitive. On the other hand, short-term rental owners tend not to vary their pricing as frequently to keep up with market data, demand, and competition. This factor may have caused vacation rental prices to remain higher.

Property Type

Even with hotel room rates so low, vacation rentals, especially those with two or more bedrooms, remain strong. This may be because people traveling as a family or in groups tend to prefer booking a vacation rental home over multiple hotel rooms, especially for longer stays, which became more common at the height of the outbreak and restrictions.

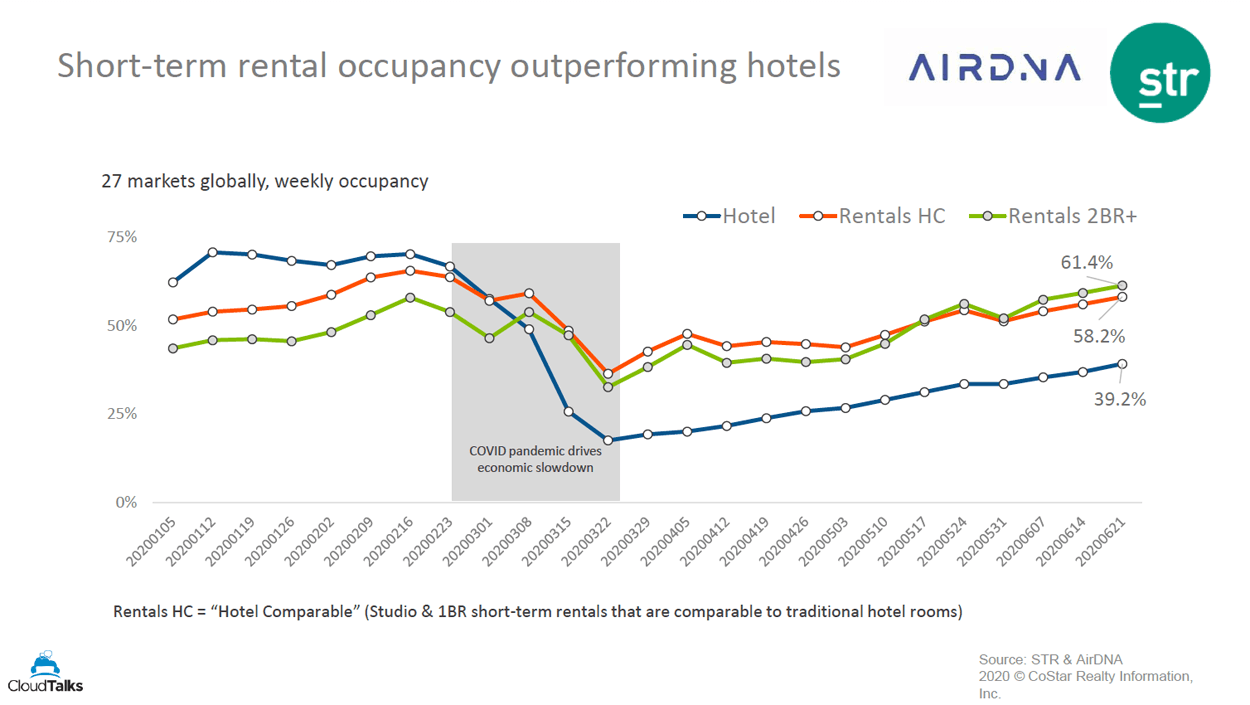

Overall, short-term rentals are more popular than hotels right now. If you aggregate up all of the 27 markets, hotels are now seeing around 39% occupancy, while smaller short-term rentals enjoy 58% occupancy and larger properties have around 61%.

Why is this? Rossmann says it has to do with the fundamental difference with the normal type of demand that goes to these property types. Hotels are much more business and group orientated, and we know that type of business still hasn’t come back in terms of demand for accommodation. So it’s no surprise that hotels would fall further and wouldn’t have recovered as fast. It’s the advantage that short-term rentals have increased focus on leisure, and also, a higher proportion of long-term stays.

Shatford reinforces that longer-term stays and vacation rentals’ ability to accommodate them have helped give them the advantage for now. But also, the types of amenities that they offer also play a part, mostly in terms of properties with a kitchen, larger spaces, and laundry facilities. He describes the ideal property type in this COVID era as, “that drive-to, single-family, standalone, control-the-access” property where you don’t have to interact with people and can feel safe isolating in an environment that’s controllable.

However, not all vacation rentals fall into this “ideal property type.” Shatfort believes that the one-bedroom, short-term rental in a multi-family unit is not going to do as well as hotels. He spoke particularly about the type of vacation rental that belongs to a host that has one property, doesn’t have professional cleaning services, and lacks brand recognition.

Vacation rental vs. hotel recovery: who wins?

With occupancy, ADR, and RevPar in decline across the board, it’s hard to say that anyone is really a winner these days. If you go by the numbers, it’s clear that larger, more premium short-term rentals, located in regional destinations that are within driving distance from a city center are posting the strongest occupancy and ADR numbers. With a limited supply of those types of rentals and strong demand, they’re in a good position currently.

Lake towns are on fire in the U.S. Anything that’s within 100 miles of a major metropolitan market that’s got a body of water is doing amazing right now in the US. – Scott Shatford, AirDNA.

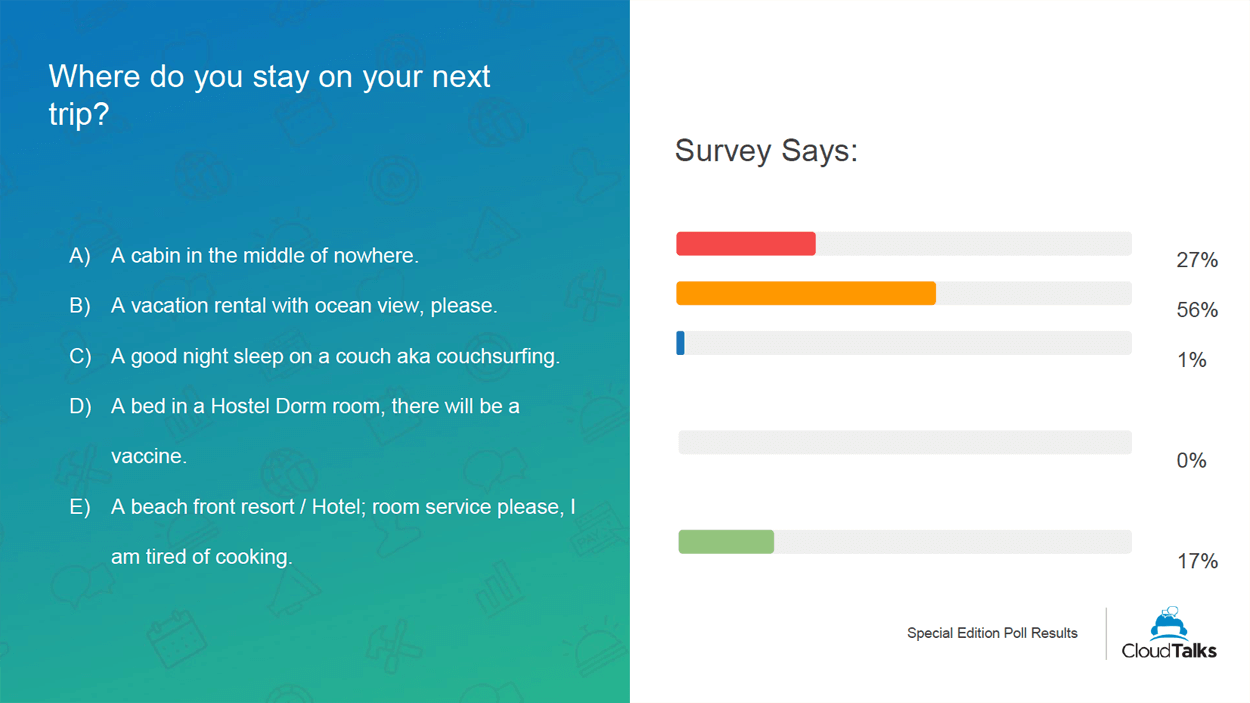

Ocean views were also popular among webinar attendees, with 56% of those polled dreaming of a holiday rental with an ocean view. We also had 27% looking to escape to a cabin in the middle of nowhere and 17% preferring a beach resort with room service for a little pampering. The poll results make a lot of sense when compared to the data at hand.

Watch the webinar replay for more short-term rentals vs. hotel recovery data, future predictions, and the full analysis from STR, AirDNA, and Cloudbeds.

Looking for software to manage your short-term rental property or hotel? Learn more about Cloudbeds’ solution for vacation rentals or hotels.