In the wake of the pandemic, hostels saw surging demand and soaring costs. By 2024, growth began to level off, but costs remained high. In 2025, these conditions are expected to persist, compounded by increasing price sensitivity among travelers and an ongoing labor crisis – putting even greater pressure on profitability.

For hostels, 2025 is the year of optimizing performance – striving for the best possible results across marketing, revenue management, operations, and the guest experience – in a market that demands agility.

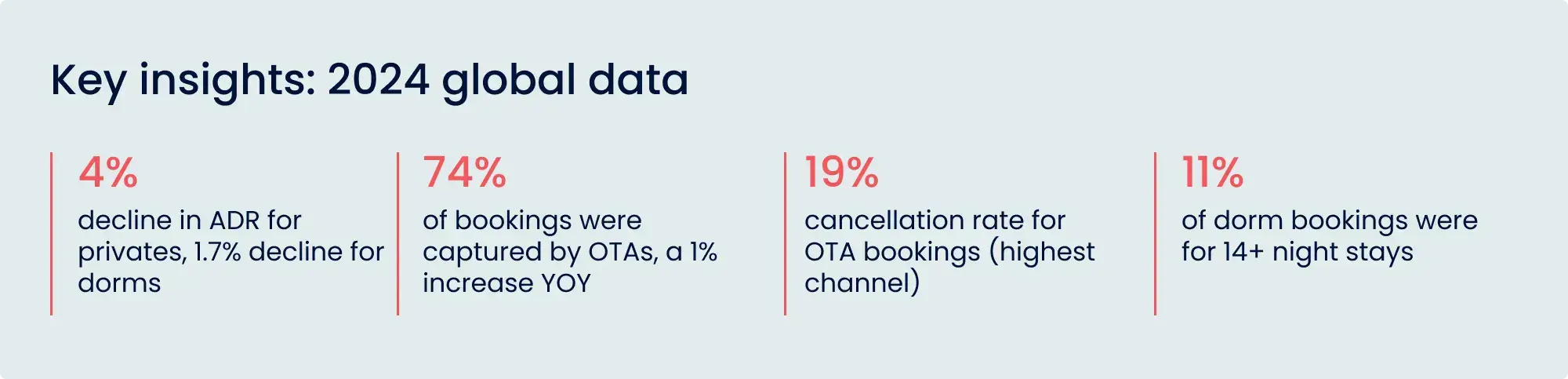

This analysis includes data exclusively from hostels, representing everything from small hostels to groups. It draws on a primary data set of 2,300 hostels across 62 countries and nearly 11 million bookings between 2022 and 2024.

The report offers a snapshot of travel patterns operators can expect in 2025, along with strategies to optimize performance in a challenging and unpredictable market.