By Cloudbeds

Since the first quarter of 2020, the global lodging industry has encountered widespread changes and adaptations in the wake of COVID-19.

As a part of the lodging industry, we at Cloudbeds want to further understand the challenges facing our customers and community so we can lend valuable insights and support to your recovery plans as we move forward.

There’s no better way to make important decisions about your business than with the support of data. Cloudbeds is here to bring you key market insights by running a series of short surveys intended to shed light on how independent owners and operators around the globe anticipate travel and reservation trends will take shape during the next 12 months.

Our first Cloudbeds Sentiment Survey was conducted back in May (summary and results can be seen below) and included feedback from 1,000 independent owners and operators across 65 countries. In our July Sentiment Survey, more than 1,500+ Cloudbeds users from 100+ countries and across all property types participated. Here are some of the key findings:

July 2020 Sentiment Survey Results

Ratio of Closed vs Open Properties

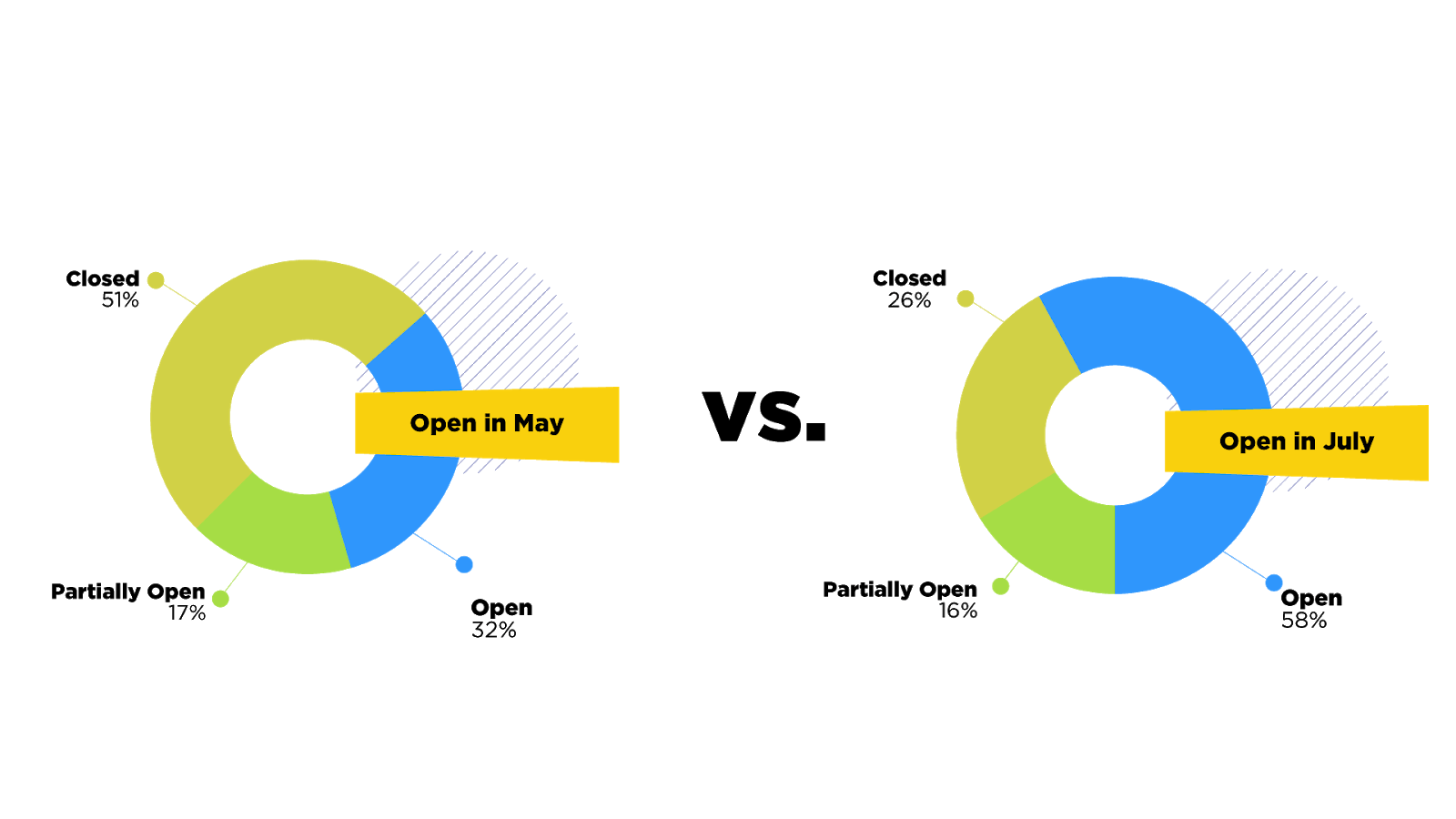

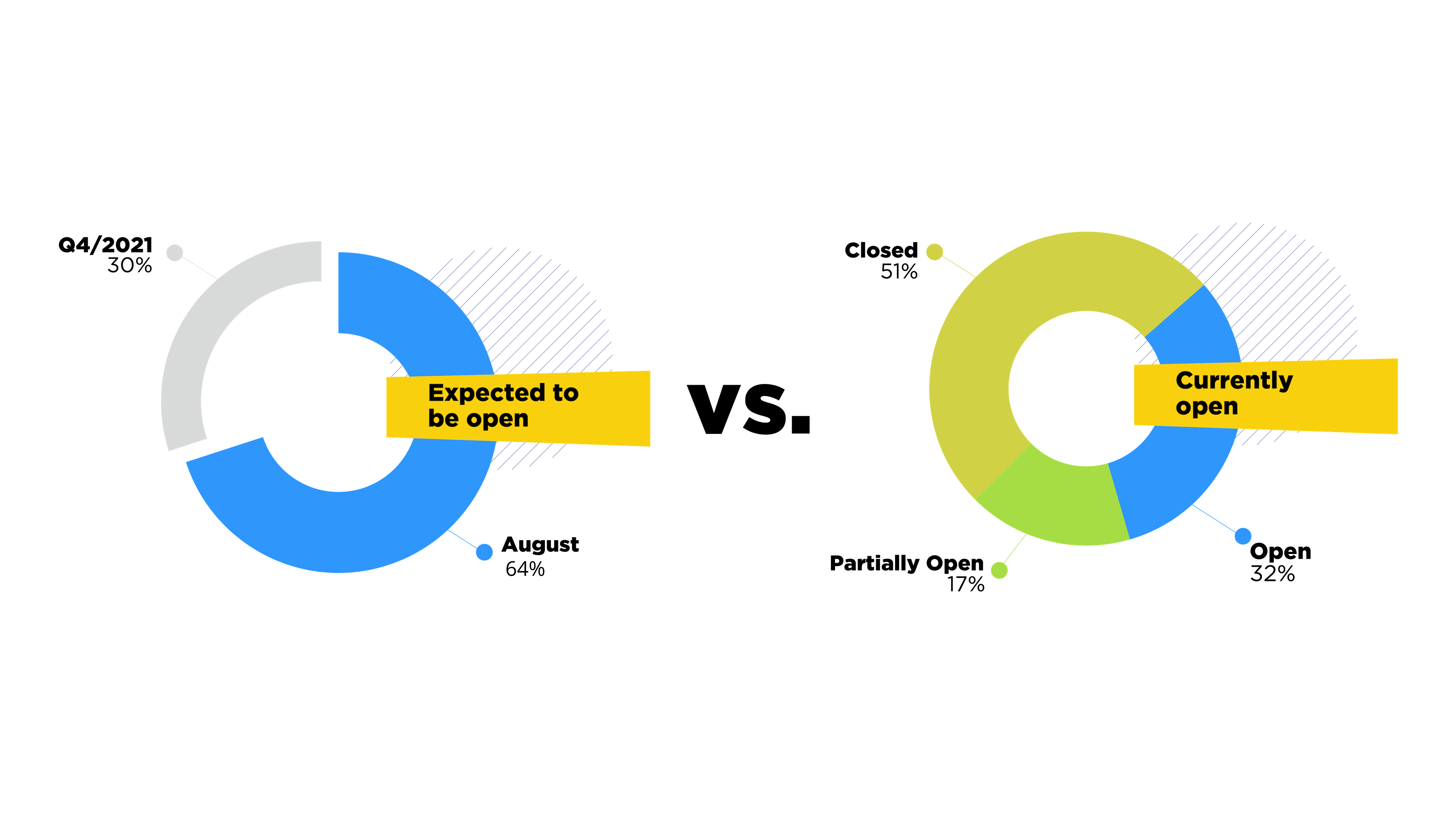

In comparison to our poll conducted in May, we’ve seen a 26% increase in properties that are fully open and accepting guests. 80% of all properties expect to be open by December 2020.

Even though in May 64% of properties had expected to be open and only 58% have been able to do so, the trend shows that not only have government regulations let up but also many owners and operators have been able to adapt their businesses to become operational. Some of the adjustments shared by hoteliers and hosts in our CloudTalks webinar series include adopting contactless technologies, showcasing cleaning procedures, making use of government support, modifying cancellation policies, creating alliances with fellow property owners to share best practices, and moving spaces around to implement social distancing practices.

Additionally, during Cloudbeds’ customer recovery support efforts, our team of hospitality consultants have helped properties make a number of modifications to help keep their businesses running. Hundreds of properties have signed up for our free, one-on-one Account Optimization program, through which our team has aided customers in boosting their revenue and improving system performance using an enhanced distribution strategy. Whether you’re a customer or just curious, see how Cloudbeds can help you build a future-proof business.

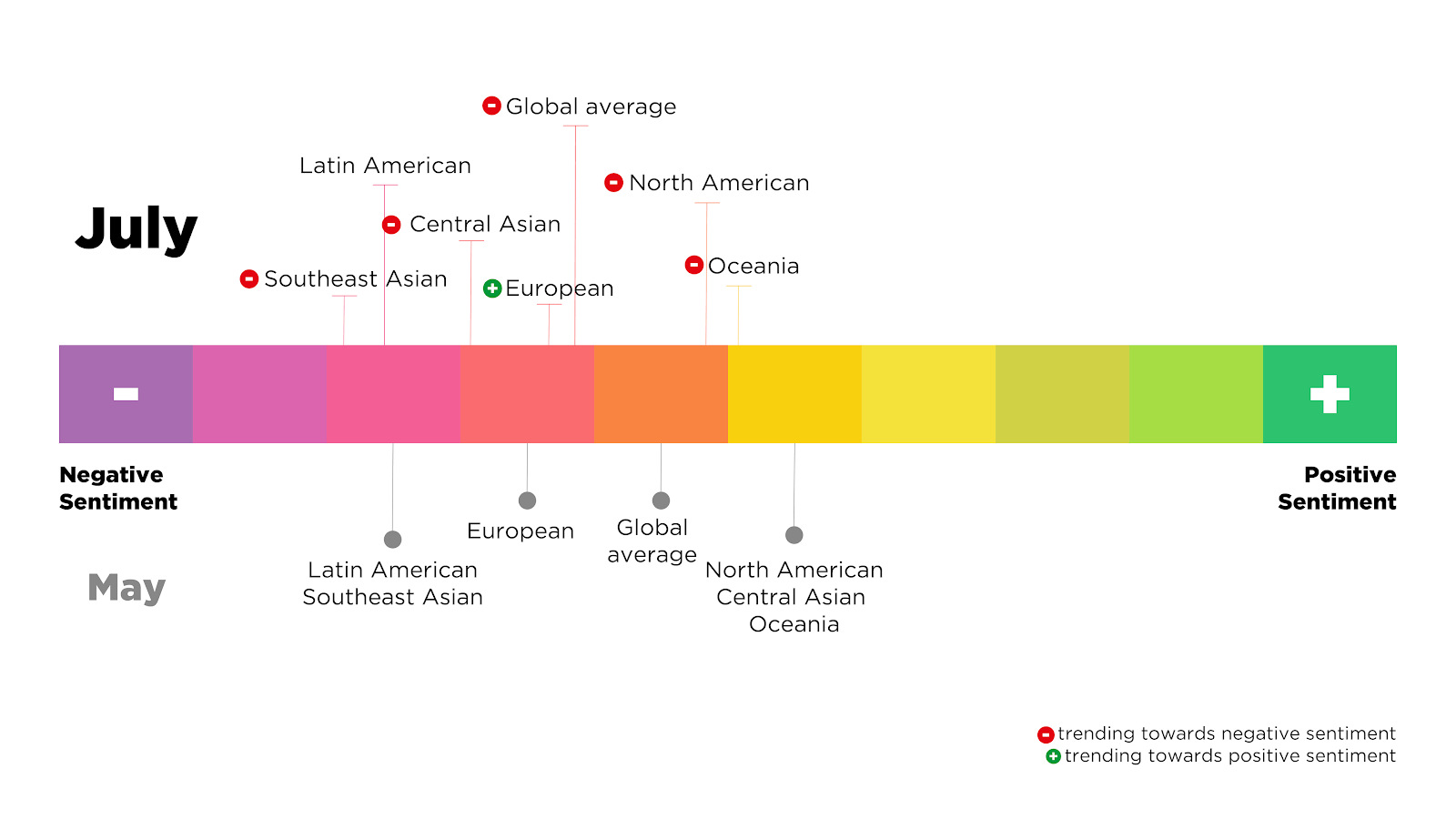

However, even though more properties have been able to open up and welcome back guests, general sentiment, including from open properties, has decreased since our last survey. For example, the sentiment score in North America has decreased by 19% from May to July.

Regional Trends

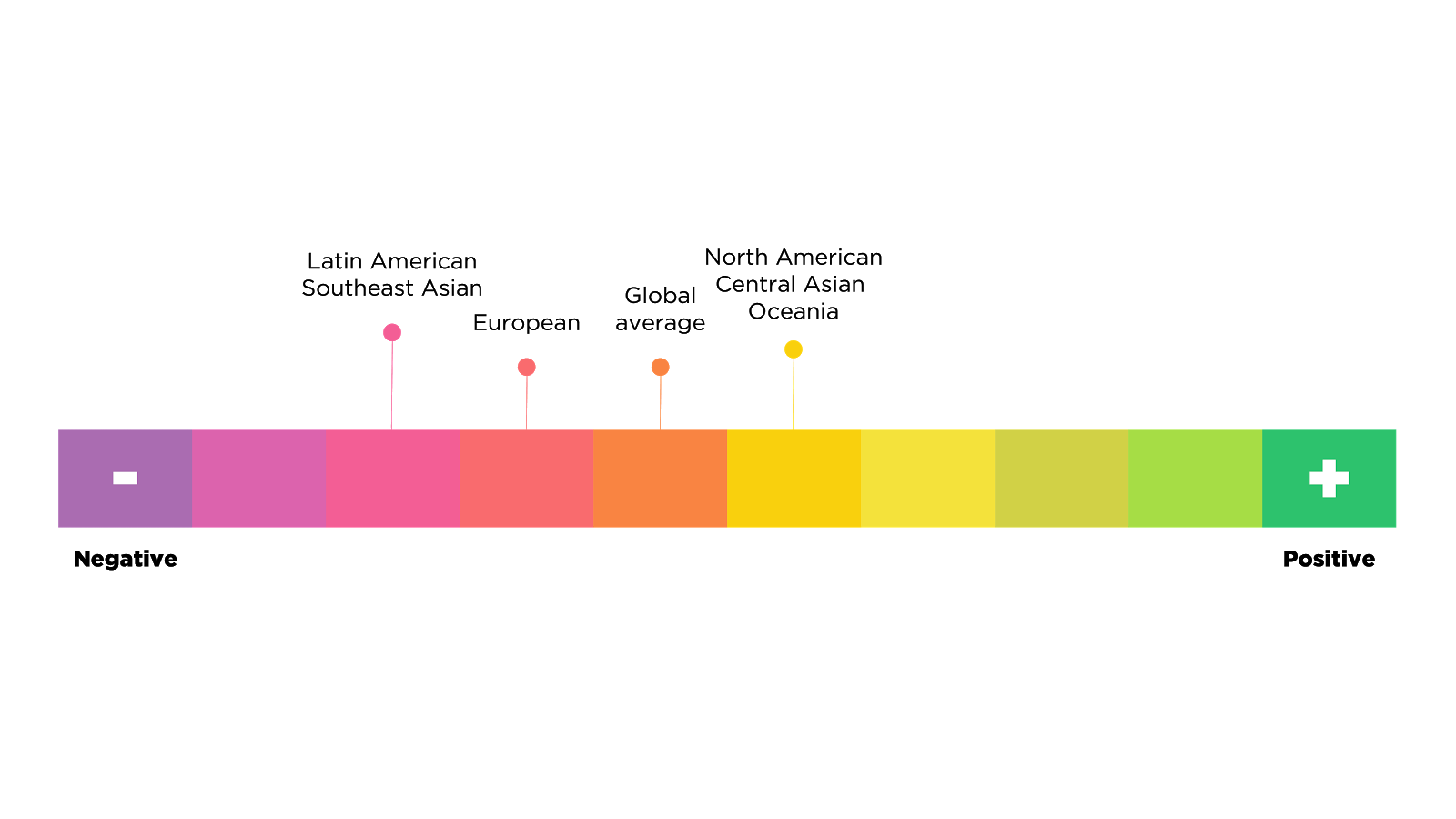

We noticed different sentiment trends depending on the region. Survey participants from North America, Western Europe, and Oceania responded with moderate optimism about the remainder of 2020. On the other hand, participants in Latin America, Europe, and Southeast Asia responded with a less positive outlook.

Also, sentiment in developed economies tends to be much more positive than in developing markets. This could be due to the fact that businesses in developed countries have received or have access to more support. One country that stands out as an outlier is Brazil where sentiment remains somewhat positive despite high case numbers.

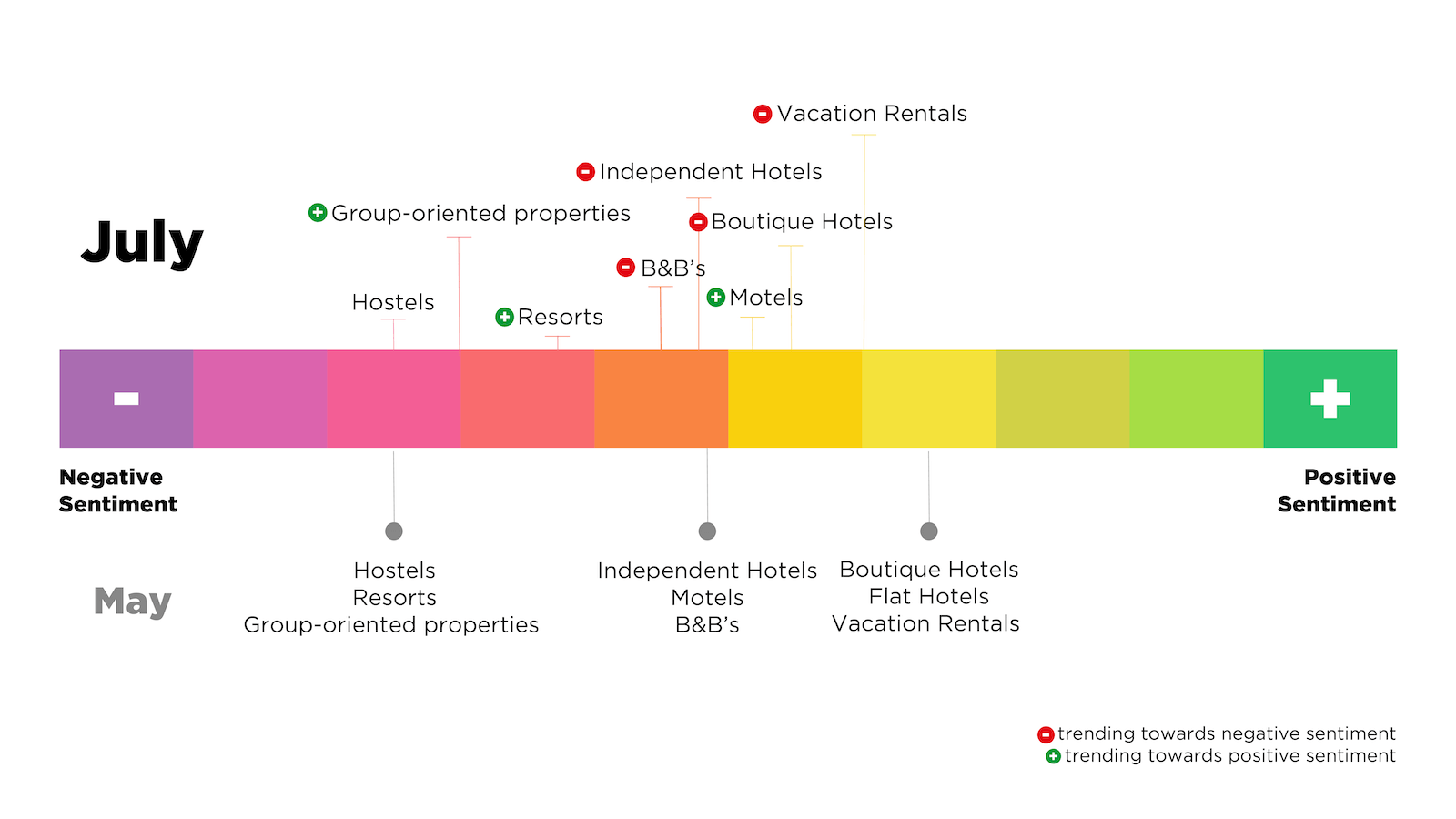

Trends by Property Type

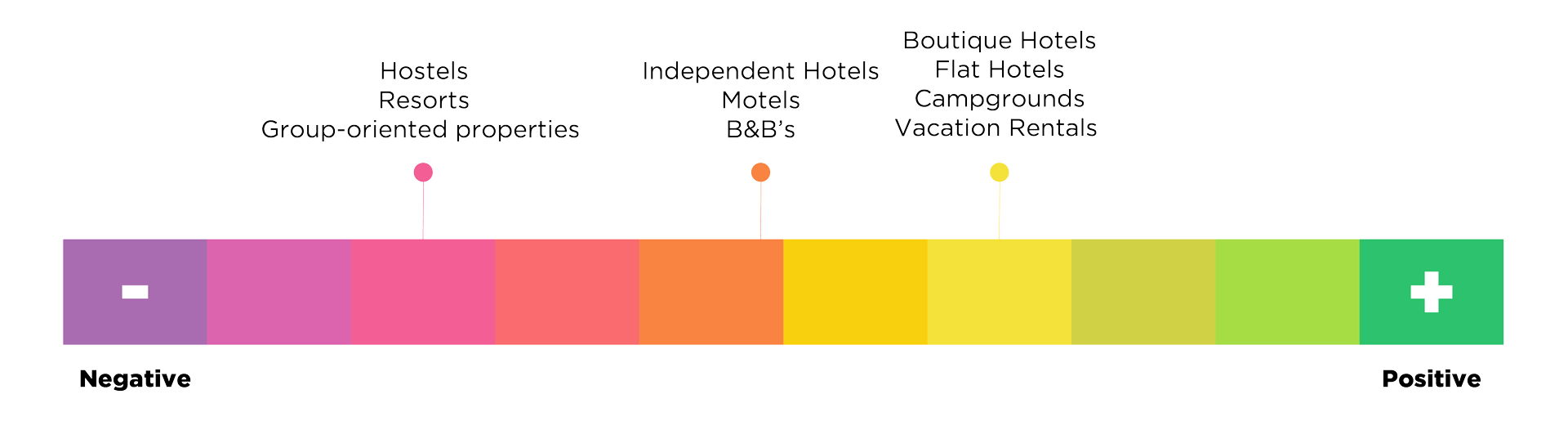

Sentiment also varies by property type, with vacation rentals, motels, and flat hotels showing a mostly positive outlook for their reservations through the remainder of 2020. Market data from a recent CloudTalks webinar with STR and AirDNA shows that certain vacation rentals have experienced decent occupancy rates throughout the pandemic. Also, an increase in road trips has also put motels on the rise.

Meanwhile, hotels and B&B’s show a neutral to a positive outlook, while hostels, guest houses, and properties that depend on group business lean more pessimistic. These findings make sense when we take into consideration the state of international travel and current social distancing recommendations. For example, hostels rely on international travelers to fill a large portion of their inventory, and shared dormitories will need to adapt to new social distancing standards to be able to operate safely.

Resort properties have shown the biggest change in sentiment, going from a negative outlook to a more positive one since our survey in May.

In addition to this sentiment survey, we’ve released a robust market insights dashboard to help customers anticipate demand and plan for the future by observing occupancy, booking, and cancellation trends on a country-by-country basis.

May 2020 Sentiment Survey Results

More than 1,000 independent owners and operators across 65 countries responded to Cloudbeds’ May sentiment survey, providing unique insights into the community’s feelings about the lodging industry and guest behavior in the upcoming year.

The survey incorporated timely questions that included everything from the timing of restriction liftings to the predicted distribution of reservations. Let’s dive into the data to explore our most compelling findings.

The third quarter of 2020 seems to be the launchpad for full-term recovery in some regions, with 64% of respondents expecting to be fully open by late August. This anticipated outcome indicates growing positivity as only 32% of the respondent properties are currently fully open.

When customers were asked to compare their reservations pre and post COVID, their responses were consistent with emerging demand data and growing optimism that the industry will follow a returning path to 2019 levels over the next 18 months. After analyzing the submitted responses, the following trends have become evident:

Reservations trends

-

- 43% of independent owners and operators expected to have more local travelers visiting their properties than in the prior year, and 22% of respondents expected to have about the same amount as last year.

- 35% expected to have fewer local travelers visiting their properties than in the prior year.

- Regarding guests from international destinations, 78% expected to have fewer international guests than the year before. However, respondents believe that further changes to restrictions would change this sentiment.

Regional Trends

-

-

- North American, Central Asian, and Oceania properties responded with moderate optimism about the remainder of 2020, expecting to increase their reservations through the balance of 2020.

- There appears to be a strong correlation between positive sentiment data and the strength of central government support offered in developed economies like Australia, New Zealand, Singapore, the United States and Germany.

- Latin American, European, and Southeast Asian properties responded with a more reserved outlook, with more respondents not expecting their reservations to increase until early 2021.

- Latin America is demonstrating low sentiment and very sporadic recovery of reservation activity. This sentiment is perhaps attributed to the region being earlier in the pandemic’s cycle and the still-growing number of cases.

- The global average for optimism remained neutral.

- North American, Central Asian, and Oceania properties responded with moderate optimism about the remainder of 2020, expecting to increase their reservations through the balance of 2020.

-

Trends by property type

-

- Boutique Hotels, Flat Hotels, Campgrounds, and Vacation Rentals have a mostly positive outlook for their reservations through the balance of 2020.

- Independent Hotels, Motels and B&B’s have a neutral to a positive outlook.

- Hostels, Resorts, and group-oriented properties have a mostly negative outlook.

- The negative outlook from hostels specifically could be due to the fact that most hostels rely on international travelers to fill a large portion of their inventory and that shared dormitories will need to adapt to new social distancing standards. With the restrictions on international travel, hostels are potentially the most heavily impacted property type, with the exception of Europe because its largely international audience doesn’t need to rely on flights for travel.

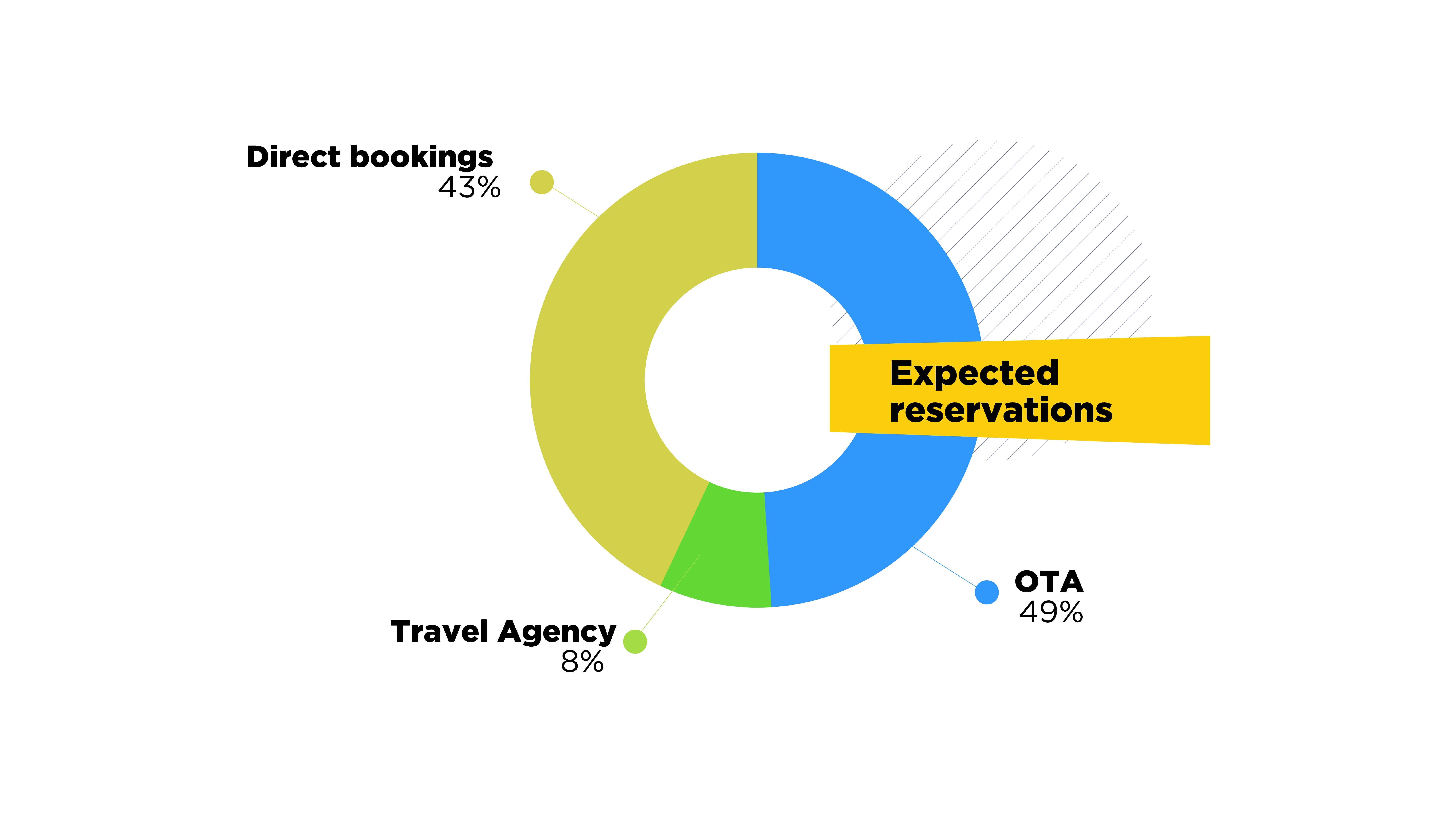

- Direct bookings represented 43% of expected reservations, whereas OTA reservations were estimated to represent 49% of expected reservations.

In addition to this sentiment survey, we have released a robust market insights dashboard to help customers anticipate demand and plan for the future by observing occupancy, booking, and cancellation trends on a country-by-country basis.