By Lana Cook

Does anyone carry cash anymore? While cash used to be king, today’s consumer has adopted more convenient payment methods that are readily available on their phones, watches, and laptops.

While the cashless trend has taken a bite out of cash tips for employees, it has been a big boost to hotel eCommerce. It’s also helping to speed up and streamline hotel operations.

Here, we discuss the most popular payment methods today, why it’s important for hotels to offer a variety of payment options to guests, and how an integrated hospitality payments solution can make the payment experience easier for lodging businesses and guests alike.

The evolution of hotel payment methods

The world is going digital, and currency is no exception. Thanks to the introduction of smartphones and digital wallets, in-person cash payments have almost disappeared. In the past, consumers would’ve paid a friend back or made a quick transaction in cash, but today, they are using Venmo or tapping their Apple Watch. In 2020, global cashless payment volume represented an estimated one trillion transactions and is expected to triple by 2030.

Of the major regions in the world, Asia Pacific, already the global leader in digital payments, is forecasted to grow the fastest in terms of cashless transaction volume in the coming years, followed by Africa, Europe, and Latin America. Growth in the U.S. and Canada is expected to be slower than in other regions, though still significant, in part due to rapid growth in previous years.

Looking at the future of payments, James Lemon, Global Lead of Travel, Transport, and Leisure at Stripe, shared his vision on The Turndown, saying he hopes “payments become invisible.” Noting that “it’s not inconceivable that you might have to tap a watch, but why should [you] actually do anything to get a card or cash out of [your] wallet? An invisible guest experience and frictionless payments is definitely where I see things going.”

Leading the charge toward a cashless society are Gen Zs and Millennials. More tech-savvy than older generations, younger consumers are less likely to carry cash, more likely to seek quick and convenient payment options, and more open to trying new methods. However, older generations are recognizing the advantages and aren’t far behind.

Popular payment methods

It’s crucial for lodging operators to understand the importance of variety in their payment offerings. A study conducted by Ecommpay found that 65% of Gen Zs were very likely or somewhat likely to abandon checkout in the middle of a payment if their preferred payment method wasn’t available. Millennials are even more sensitive, with 78.7% ready to abandon carts.

This abandonment issue is evident when consumers try to book directly on a hotel’s website but don’t see the option to use digital methods like Apple or Google Pay. While some consumers will dig through their wallets to find their credit card, many will turn to an OTA to book (hello commissions) or find another property offering more convenience.

Creating even an ounce of friction in the guest experience can significantly impact the relationship between you and your guests. That’s why it’s essential to start the experience right and give travelers no reason to leave your site. Here, we identify some of the most popular modes of payment used by consumers today.

Credit cards

Visa, Mastercard, American Express, and Discover are the four biggest credit card networks in the world. While banks typically are the issuers of credit cards under these brand names, credit card networks enable electronic transactions between cardholders and merchants through their respective banks. They facilitate the authorization, clearing, and settlement of credit and debit card payments.

Credit card payments can be divided into three main types of transactions:

- Card-present: The customer and the card are physically present at the business.

- Card-not present: The customer and the card are not physically present at the business.

- Contactless: The customer and the card are present at the business but there is no physical contact between the customer and the employee or payment terminal. Payment is made by waving the card over the reader.

Specialty credit cards

In addition to the big four, there are numerous smaller credit card brands that are popular in select countries and with certain segments of consumers. For example:

- JCB. A credit card issued in Japan that is popular with Japanese travelers.

- Union Pay. A credit and debit card issued in China that’s popular with Chinese travelers.

- Diners Club. A U.S.-based charge card that is used for travel and dining services.

- Maestro. A brand of debit cards issued by Mastercard.

Digital wallets

Also called mobile wallets or e-wallets, digital wallets are applications that store credit card information on a mobile device, allowing users to make contactless payments by holding their phone over the payment terminal. Popular mobile wallets include Apple Pay, Google Pay, and Samsung Pay.

Localized payment methods

Local payment methods are typically government-sponsored and help keep costs lower for travelers in that region. Local payment methods to consider include:

- iDEAL. Netherlands-based iDEAL is an online payment method that allows consumers to pay via their own bank.

- SEPA. The Single Euro Payments Area (aka SEPA) allows customers to make cashless euro payments via credit transfer and direct debit in 35 European countries.

- SOFORT. Popular in Germany, SOFORT allows users to use their own online banking details to make purchases online.

- Interac. Canada-based Interac handles debit card payments and allows users to send money using Interac e-Transfer from their phone or laptop.

- OXXO. In Mexico, OXXO is a popular program that allows consumers to buy items online using payment vouchers that can be prepaid in cash at OXXO convenience stores across the country.

- PromptPay. PromptPay is based in Thailand and allows users to transfer money with lower fees using their citizen ID, mobile phone number, and bank account.

Other payment types

Additional payment types include:

- Buy now, pay later (BNPL). This is a type of short-term financing allowing consumers to pay for purchases by installments on a future date, often interest-free, instead of upfront at the time of booking. Popular BNPL services include Affirm, Afterpay, and Klarna.

- Bank transfers. Not widely used today, bank transfers require consumers to transfer funds directly from their bank to a hotel’s bank to book. Tedious, time-consuming, and inconvenient, bank transfers are primarily used in countries where credit cards are not widely used.

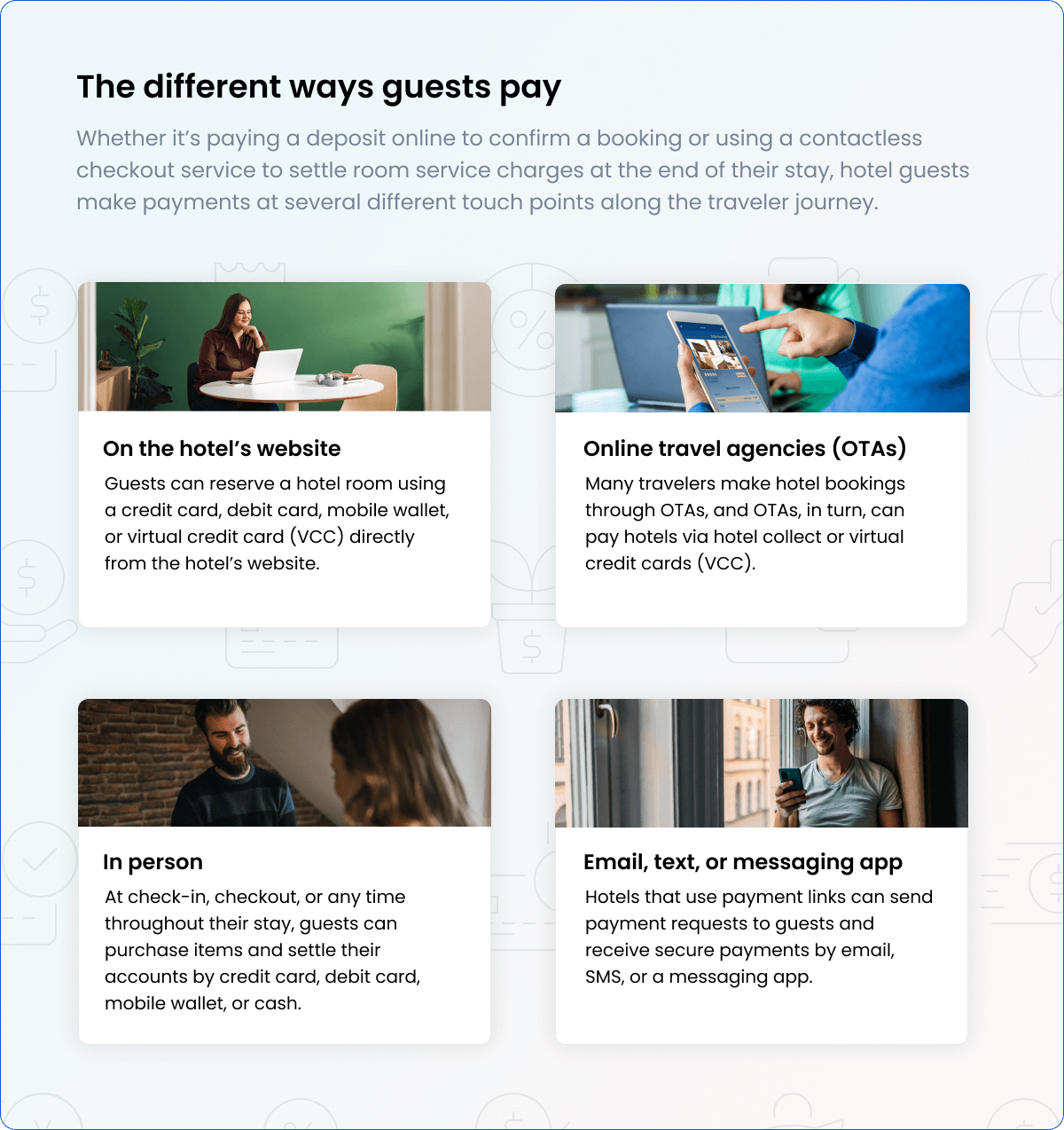

The different ways guests pay

Whether it’s paying a deposit online to confirm a booking or using a contactless checkout service to settle room service charges at the end of their stay, hotel guests make payments at several different touch points along the traveler journey.

- On the hotel’s website. If a hotel has a website booking engine integrated with its property management system (PMS), guests can reserve a hotel room using a credit card, debit card, mobile wallet, or virtual credit card (VCC) directly from the hotel’s website and the information is automatically populated into the PMS. Nowadays, most consumers are comfortable making online payments this way.

- Email, text, or messaging app. Hotels that use payment links can send payment requests to guests and receive secure payments by email, SMS, or a messaging app such as WhatsApp or via guest experience software. Pay by link makes contactless check-in much easier, streamlines the direct booking process, and simplifies mobile payments. Chad Brubaker, Senior Director of Product at Cloudbeds, explains more below.

- Online travel agencies (OTAs). Many travelers make hotel bookings through OTAs like Booking.com and Expedia due to familiarity and convenience. OTAs, in turn, can pay hotels in two different ways: hotel collect, where the hotel charges guests directly, or channel collect, where OTAs charge guests and pay hotels using a virtual credit card (VCC). VCCs passed from OTAs can pose challenges for lodging businesses, such as high transaction fees and loss of guest payment details (which have to be collected at a later date).

- In person. At check-in, checkout, or any time throughout their stay, guests can purchase items and settle their accounts by credit card, debit card, mobile wallet, or cash using a payment gateway terminal at the front desk or point-of-sale (POS) system property-wide. Whereas older generations are more likely to pay by cash or with a credit card, younger generations increasingly prefer to pay by mobile wallet.

Benefits of offering multiple payment methods

The hospitality industry is unique in that properties welcome travelers from all over the world, requiring more thought around methods of payment, currency, and conversions. While this complicates processes, lodging businesses that carefully consider their payment offerings will benefit significantly. Here, we break down the key advantages of offering flexible payment options.

- Streamline the booking process. Accepting various payment methods via your booking engine will help ensure guests can make reservations when and where they prefer. Credit cards are automatically verified, and card numbers are entered into the guest profile making it easy for guests to book directly with you.

- Capture more bookings. By accepting online reservations guaranteed with a payment card, you are positioned to maximize direct bookings via your website 24/7. If you don’t accept guests’ preferred payment methods, you risk losing direct bookings to OTAs – or worse, to competitors.

- Increase revenue. With payment software, properties can set up automated authorizations, deposits, and prepayments to ensure they never miss a payment, receive a late payment, or hold a room under an invalid credit card. All of this puts more money into your pocket.

- Meet guest expectations. Today’s consumers are accustomed to using their payment method of choice when shopping online, ordering food delivery services, and taking an Uber, among countless other daily transactions. They now expect a similar frictionless guest experience at hotels, and they certainly don’t want to wait while their card is entered manually.

- Increase security and guest satisfaction. Manual payment processing procedures are vulnerable to human error, fraud, and conflicting information in guest profiles, all of which can lead to negative guest experiences. On the other hand, a secure and friction-free payment experience will help build guest satisfaction and guest loyalty.

What to look for in a hotel payment solution

While many companies offer payment software, it’s essential to find a provider with hospitality experience. Here are several important factors to consider when selecting a provider and payment system.

- Multiple payment methods. Ask the provider which payment methods they support. If they don’t accommodate methods that are increasingly popular with travelers, including mobile wallets and terminals supporting chip, tap-to-pay, and swipe transactions, they are probably not the right fit for you.

- Integration with a hospitality platform. To maximize efficiency, the payment solution should connect to your PMS, booking engine, and channel manager. When these solutions are provided by the same vendor and housed within an integrated hospitality platform, hotel management doesn’t have to manage multiple technology partners and platforms and can access more robust reports and insights.

- Operational efficiency. Integration will also save time by cutting down on manual tasks like data input and dual entry of payment information, which is prone to error, as well as facilitating payment reconciliation, reporting, management of fees and taxes, and other tedious and time-consuming tasks.

- Hospitality-focused support. The travel industry has some of the highest rates of fraud, data breaches, and chargebacks of the major sectors, creating major headaches for hotels. When you want to dispute a chargeback or need general support, you want someone on your team with expertise in both hospitality and payment processes.

- Risk management. The more payment options you offer, the more vulnerable you may be to fraud. To protect your property from payment fraud and data breaches and secure guest data and payment information, ensure that the provider is PCI-certified and fully compliant with SCA, PSD2, and 3DS regulations.

Are we on our way to becoming a truly cashless society?

James Lemon of Stripe rightfully said that the travel industry “is built on experiences,” and to deliver the best guest experience, hoteliers need to provide seamless and frictionless payments.

As part of this evolution, we will continue to see cash replaced by credit cards, digital wallets, and virtual credit cards (along with new payment methods currently in the works). All we know for certain is that as payments evolve, travelers will expect choice and flexibility from hotels.

Property owners and operators who adapt to the trends and implement the systems and technology with the functionality to offer diverse payment methods today will receive handsome payoffs in the future. That means not only more revenue but also higher operational efficiency, accuracy, and guest satisfaction.