By Cloudbeds

From increasing occupancy to generating direct bookings and increasing ADR, lodging operators have a lot on their plate. As the hospitality industry becomes more complex, the role of technology to help streamline operations and automate processes becomes increasingly important.

Cloudbeds’ State of Independent Lodging Report surveyed thousands of independent properties and came to an important conclusion – owners and operators can’t do everything alone. This year, more properties will invest in technology to help create new revenue opportunities, build better websites, manage marketing campaigns, automate services, and improve the guest experience.

There’s real power in having robust hotel management software that frees you up to focus on the guest rather than waste time on repetitive administrative tasks. Having the right tool can mean the difference between working on your business and working in it. Smaller properties are especially vulnerable to getting sucked into the current of daily operations, as the teams are small and almost always owner/operator driven.

To minimize frustrations and manage your property with ease and sophistication that impresses guests, consider hotel management software (HMS). In this guide, we break down the importance of a modern HMS solution, the features to look for, and how to choose the right provider.

Why you need hotel management software

In a recent interview with Skift, Cloudbeds’ CEO, Adam Harris, commented on the state of technology adoption in the hotel industry, saying, “the average percentage of spend for technology is a fraction of what it should be. The number one reason why we don’t sign a customer up is not that they went to a competitor, but because they’re afraid of change.”

Here’s why hoteliers need to jump the hurdle of change and adopt hotel management software today.

Your time is valuable.

As a busy hotelier, every second of the day counts.

Say your run a 15-room luxury inn nestled in the foothills. To keep it simple, we’ll only consider room revenue. The inn is high-end, with an average rate of $425 per night. At full occupancy, that’s $6,375 in potential revenue each day. At its average occupancy rate of 72%, the average revenue per night is $4,590. There are 24 hours in a day, so that’s $191.25 of revenue per hour.

What happens when you spend 15 minutes taking a guest’s reservation over the phone rather than allowing the self-service booking many guests prefer? That 15 minutes costs you $47.82 in revenue. If you were to invest that 15 minutes (or $47.82) into marketing or technology that earned a new booking, you’d nearly quadruple your money.

Now, consider your day. What’s each hour worth for both yourself and your staff? Is everyone spending time on value-creating tasks that deliver the greatest return? How is using manual methods to operate your property affecting your overall revenue?

Your time is money, so spend it on value-driven activities – such as creating a profitable hotel distribution strategy.

You’re busy enough as it is.

No matter what type of property you run, from a large or small hotel, motel, hostel, or campground, there’s always something that needs to be done: a candidate to interview, a guest to greet, a marketing campaign to launch, or a maintenance issue to fix.

Amidst the chaos, wouldn’t it be nice to have a reliable solution to lend you a hand? This is where your hotel management software can save the day. A robust HMS provides peace of mind and helps keep things under control in the following ways:

- One platform to run your property. Managing multiple systems is a hassle – especially for smaller operations. A helpful hotel management solution will combine multiple functionalities, such as a booking engine, PMS, channel manager, digital marketing, guest engagement, and reporting.

- Accessible from anywhere. Modern HMS runs in the cloud. This means you can get real-time updates and check in on business from anywhere with internet access – even after you’ve gone home for the day.

- Reduce guest complaints. Accidentally losing a guest reservation, forgetting to handle a special request, or mishandling credit card information are surefire ways to get complaints. An HMS will organize your guest information and provide opportunities to personalize service through guest messaging tools.

- Manages the back office. Payments, invoices, cash drawers, and financial reports are much easier to manage when your systems are connected and pulled from the same data source.

- Experienced support. You can’t do everything alone. Your HMS vendor should act as an extension of your team, providing expertise and support to help you manage and grow your business.

The ultimate goal is to maintain profitability and free up your time so you can work more efficiently and have less stress (and maybe even treat yourself to a vacation!).

Sanj Gidda, Director of the George Street Hotel and Bocardo Hotel, has seen firsthand the advantages of using a modern HMS as a Cloudbeds customer. Prior to adopting the Cloudbeds Hospitality Platform, Sanj used an on-premise system with non-existent support, payments challenges, and a poorly integrated channel manager, making day-to-day operations “confusing, labor-intensive, archaic, and frustrating.”

After making the switch to Cloudbeds, Sanj recommends that other properties do the same, especially those without dedicated IT teams. With Cloudbeds, Sanj says he has access to a team of people who strive to understand and support his strategy and considers the Cloudbeds team to be an extension of his own. Another bonus? Sanj says that with a cloud platform, he was able to vacation to Mexico, where he was “literally on a beach, making decisions thanks to the real-time data in Cloudbeds.”

Your guests expect flawless operations.

There are certain areas where quirky is cool and valued by guests: decor, location, and unique amenities. However, there are some expectations that properties of all sizes must meet. Good hotel property management software gives you the support you need to be flawless in the operational areas that matter most.

The right hotel management software helps you meet those expectations by providing:

- An online booking engine. Guests can book their reservations on your website rather than calling. An online booking or reservation system empowers guests and gives staff more time away from the phone to handle other priorities.

- Synchronized pricing and availability. One of the major problems with manual inventory management is noncompetitive pricing and availability. There will always be a gap between when the hotel reservation agent takes a phone booking and when that room is removed from inventory elsewhere. Sometimes, a channel may be overlooked, leading to double bookings – and displeased guests. Since inventory on an HMS with a channel manager is synced from a central pool, room statuses are always up-to-date.

- Localization. To attract more guests, you need to consider international visitors and make booking easier for speakers of other languages. Offering a booking path in multiple languages gives your property a global appeal that broadens your demographics. Guest engagement platforms also provide vital translation functionality so you can communicate with guests, no matter their language.

- Guest communication. With the rise of chatbots and messaging tools across all business types, travelers expect to be able to communicate with their lodging provider before, during, and after their stay. Whether they have a question about check-in times, need something delivered to their room, or want to let you know about a staff member that made their day, today’s hotels need to provide two-way communication between their hotel and its guests.

Your staff training and communication could be better

Training new staff is part of any business but is even more crucial in an industry with turnover as high as the hotel industry. According to the Bureau of Labor Statistics Job Openings and Labor Turnover report, the hospitality industry has the highest turnover rate of any sector at 86.3%.

When you don’t have an organized system or use complicated technology, the training process can be time-consuming and frustrating for everyone. Running your front office operations should be simple enough for any new staff member to pick up quickly so you don’t waste precious energy whenever you have a new hire.

Efficient hotel management software features include:

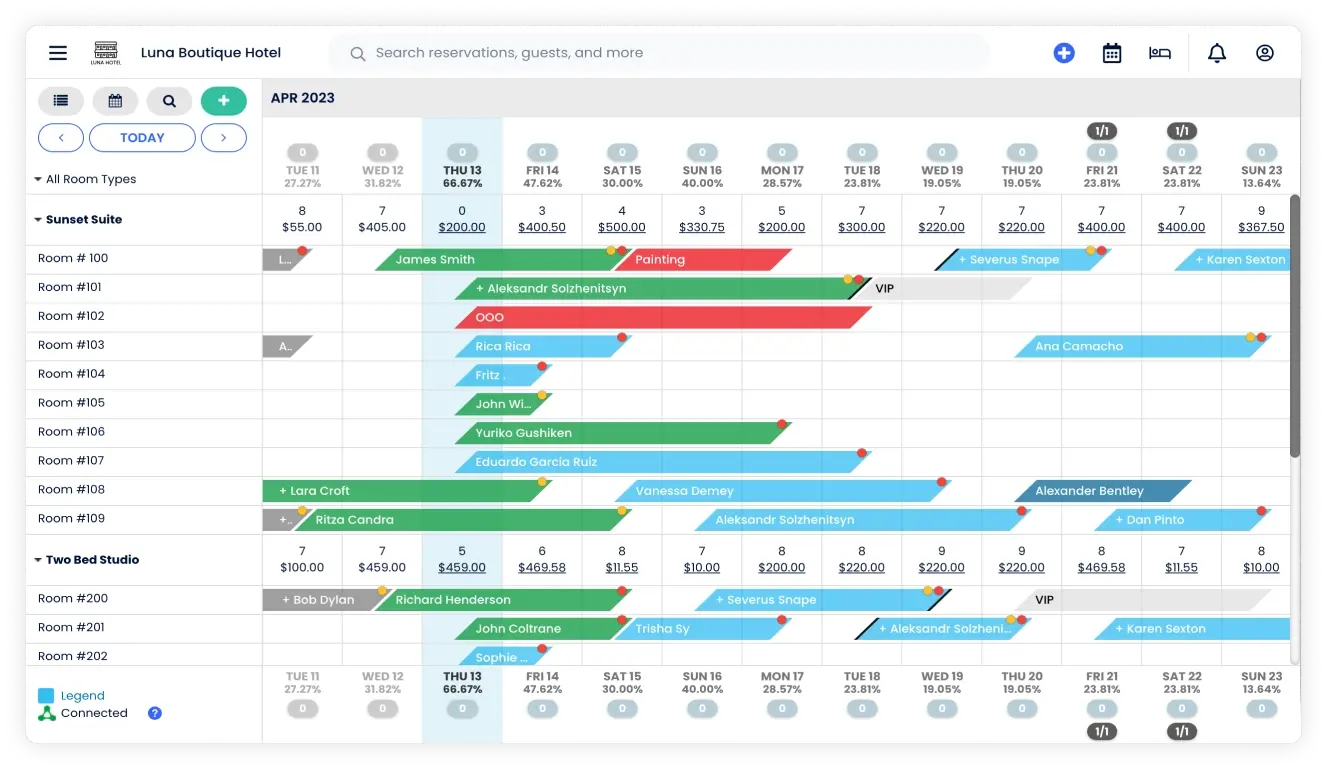

- An intuitive and user-friendly interface. It just makes sense – and works in the way that you would expect. For example, having a unified calendar view with drag-and-drop functionality that allows staff to easily assign rooms.

- Reports that reduce errors and manual busywork. With the proper HMS, you can eliminate the need for your staff to spend an entire shift in a spreadsheet or write reports by hand. Instead, your team can focus on analyzing the reports prepared by your HMS so they can identify trends and make action plans.

- Housekeeping management. The front desk should be able to view the status of each room right in the HMS dashboard and assign housekeepers to prioritize cleaning. This visibility reduces communication lapses and helps staff be more efficient.

The Cloudbeds Hospitality Platforms has an intuitive, easy-to-use interface that cuts down training times and improves the user experience.

The hospitality industry is constantly shifting

The beauty of working with a modern, cloud-based hospitality platform is that it’s updated regularly, so the technology is always fresh and ready to support the changing needs of your property. New features and functionality lead the way to better methods of engaging with guests and operating your property profitably. Nonetheless, your hospitality management system should encourage connections to other hospitality technology with a robust menu of integrations so that you can craft the ideal tech stack.

9 important features of hotel management software

Independent hotels stand to boost productivity and gain revenue by adopting hotel management software. The power lies in the comprehensive nature of a system that works together to achieve the best business outcomes.

Hotel management software must do one thing well: help you run your hotel better. It’s not meant to be an additional burden to manage.

Digital hotel management software eliminates silos and streamlines operations across the entire business. With full transparency and shared visibility, the whole team works from the same information. Hospitality software reduces service lapses and makes guests (not to mention your staff) happier.

When it comes down to selecting the best hotel management software for your independent hospitality business, these are key features to look for.

Watch this short video to learn about the nine main features.

1. Cloud-based

Modern and powerful SaaS is cloud-based. This is in opposition to solutions that host hardware on-premise. Cloud computing technology is affordable, scalable, and fast. It’s also much easier to update regularly than a system that requires expensive physical upgrades. Cloud-based HMS can also be accessed from anywhere with an internet connection, so you don’t have to physically be at your property to check in on your business.

2. Intuitive interface

In an industry that competes so vigorously for talent, why spend precious time training employees on a system that takes ages to load and makes it impossible to find what you need? Employees want simple tools that are easy to use and learn. Similarly, owners and managers often need to train new staff regularly, so user-friendly hotel management software makes a business run smoother.

3. Integrated booking engine

An HMS with an integrated booking engine can help streamline reservation management, allowing guests to book reservations themselves which leads to more direct bookings. And, when it includes a payment processing tool, you can receive new bookings on your website 24/7.

An embedded booking engine gives you much more control to offer bundles and packages that reflect different guest interests. Added personalization can bring incremental revenue to hotels, no matter the property’s size.

An efficient booking engine will:

- Include multiple languages and currencies. Choose an engine with localization support to attract and accommodate international visitors.

- Accept secure payments. Take reservations on your website around the clock and assure guests that their payment is secure with a reputable payment gateway.

- Offer a rate comparison tool. Another powerful way to build trust and convert more bookings is with a Rate Check widget. Be transparent and give users the confidence that they’re getting the best rate on your website.

- Be customizable. Your booking engine should seamlessly match your website design to be consistent with your brand and not feel out of place.

- Integrate with your PMS and channel manager. Reservations made on your website should automatically sync with your hotel property management system and across all your OTA channels so you don’t get overbookings.

- Can be added to your social media profiles. Don’t miss out on the opportunity to capture additional bookings via your different social channels. Many travelers use Instagram and TikTok’s mobile apps for travel research, and by providing a link in your bio, you can convert these users.

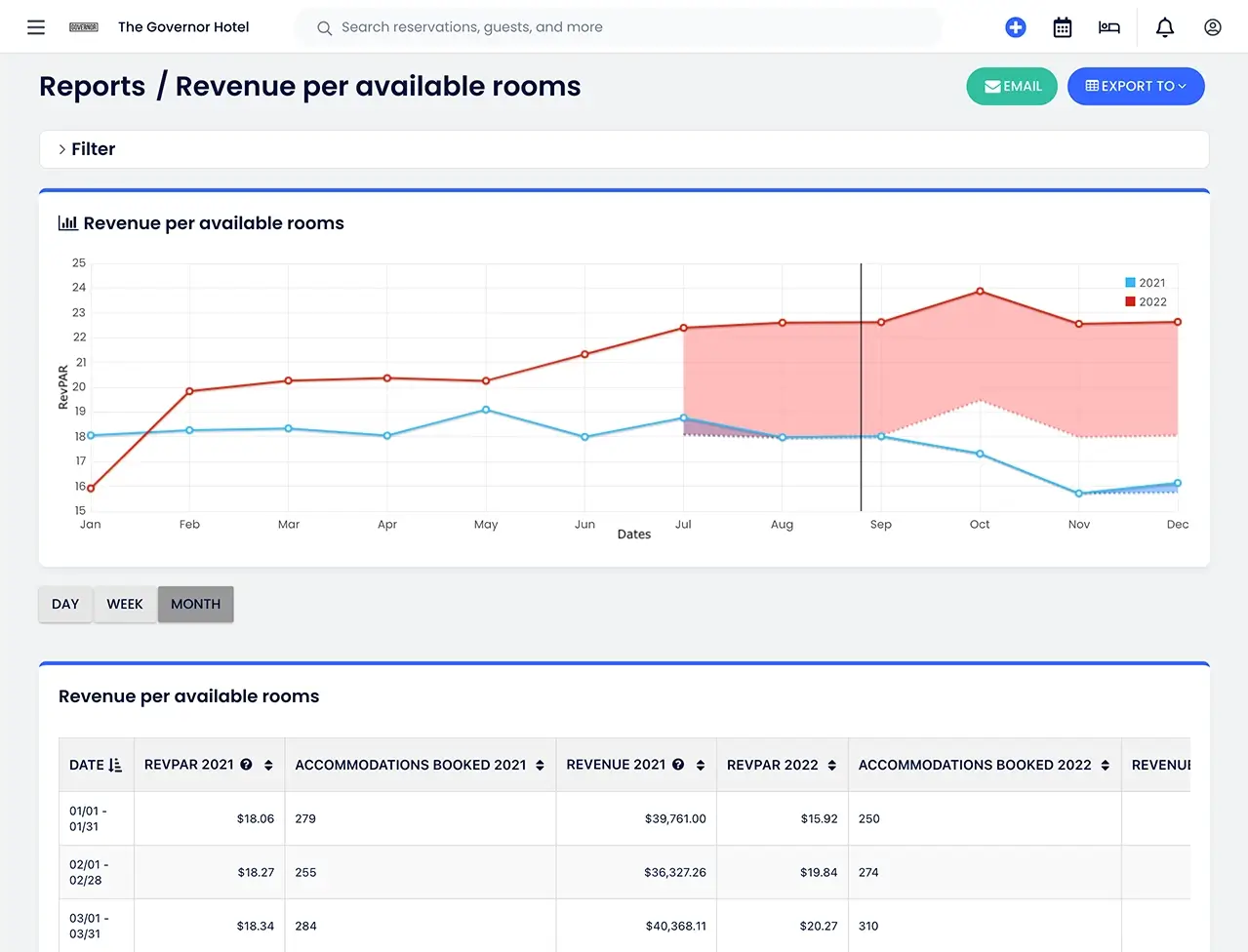

4. Detailed reports

Robust reporting enables hoteliers to make data-driven decisions. Using data to improve operations and marketing strategies used to be a privilege for big-budget hotels only. Not anymore! With the right hotel management software, independent hotels can make smart decisions with data and create comprehensive reports that give visibility into your property’s finances, daily activities, analytics, and more.

Detailed reports give you more clarity over your business efforts. Once you know exactly how much revenue each OTA generates for you, you can develop a channel mix that delivers the highest ROI. Dynamic reporting modules should let you create reports in-browser, as emails, or as downloadable spreadsheets and PDFs with the ability to filter by marketing channel, room type, year, specials, and other key parameters.

The Cloudbeds Hospitality Platform offers a variety of reports to analyze your daily operations and finances.

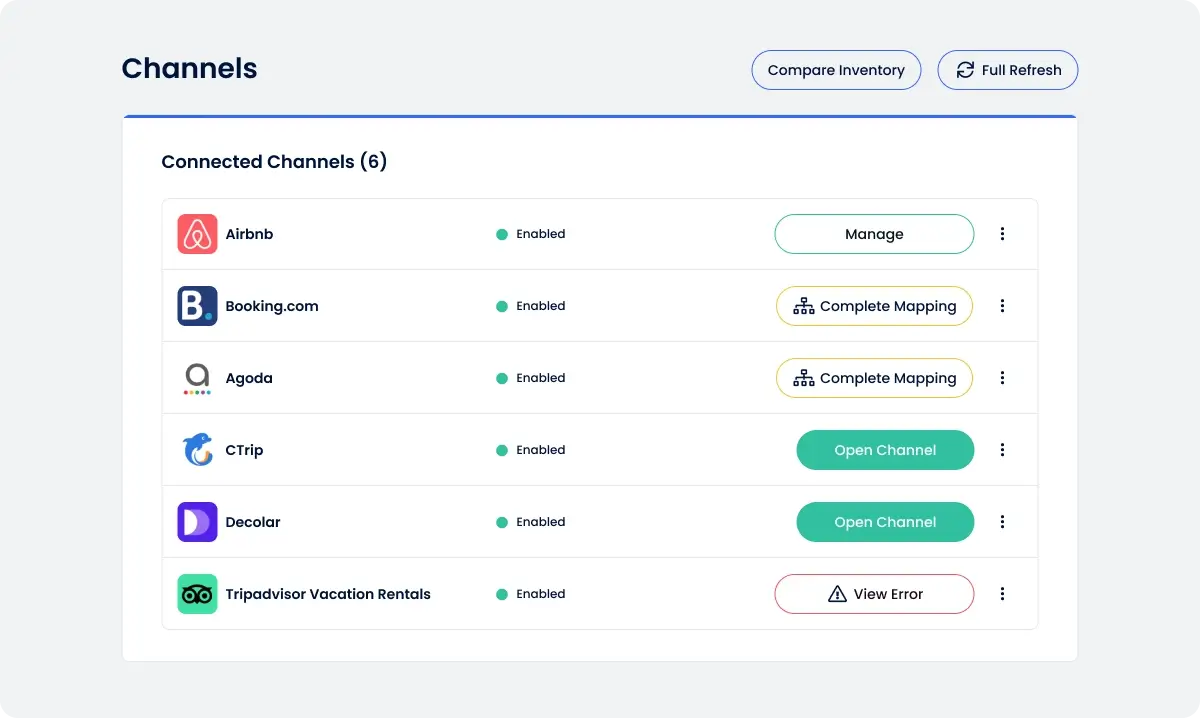

5. Channel manager

A channel manager organizes how your inventory is distributed across online travel agencies such as Booking.com, Airbnb, and Expedia. When integrated with your hotel management software, the channel manager will update your availability on your calendar in real-time. Other benefits of having a channel manager as part of your hotel management software include:

- More visibility and guests. Connecting to different types of OTAs using your channel manager will give you the benefit of displaying your property to a larger number of potential guests from around the world. Also, you’ll be able to find smaller, more niche OTAs that will attract your ideal guest and charge lower commissions.

- No more overbookings. When you have a channel manager that’s synced with your hotel management software, gone will be the days of manually updating your availability across multiple channels and having various logins to different extranets. Nothing beats the ease and convenience of having all of your tools in sync.

- Greater control over your rates and availability. With a channel manager, you can set different pricing and availability on a per-channel basis, so you have full reign over how you sell your property.

6. Revenue management

Your hotel rates shouldn’t be “set it and forget it.” To maximize revenue, your pricing needs to be dynamic and consider factors like competitors’ rates and local events that may affect your profits. It’s not feasible to constantly adjust your pricing manually. With automation, pricing can be adjusted intelligently to reflect real-time demand.

Ideally, your hotel management software should automate at least some of your pricing decisions. Depending on the size and complexity of your property, it’s crucial to have access to everything from a pricing intelligence engine to a full-blown revenue management solution.

7. Digital marketing

It’s not enough to just distribute your inventory via OTAs if you want to maximize revenue and be in control of your guest data. A digital marketing solution helps hotels build awareness and drive bookings across multiple channels, contributing to a more well-balanced distribution strategy.

Look for hotel management software that offers a hospitality-focused marketing solution that includes features such as:

- Beautifully designed and optimized websites. Your website is the foundation of your marketing strategy and plays an important role in establishing trust with travelers and guests. Your website should be modernly designed, easy to use, and optimized for mobile.

- Metasearch advertising. 75% of travelers use metasearch in their search process, making it a critical platform for lodging operators to be active on. Metasearch advertising can help you increase visibility on platforms like Google Hotel Ads and Trivago so that travelers book direct.

- Business listings maintenance. Accurate business listings across your Google Business Profile, online directories, and other apps are crucial in boosting your presence in organic and paid search.

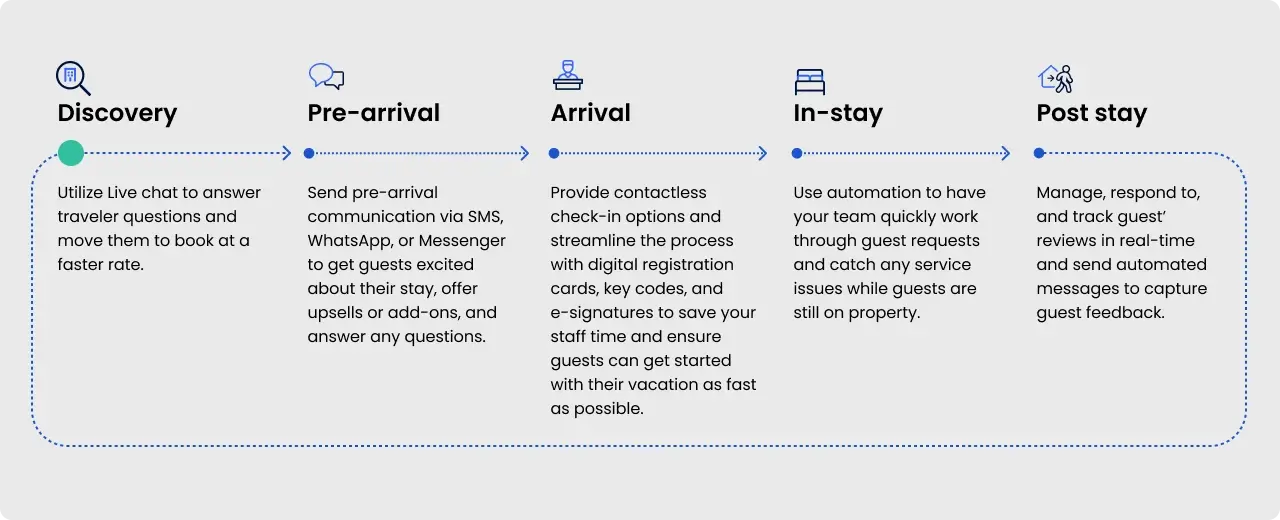

8. Guest engagement

The guest journey has become more complex, with lodging operators expected to engage with guests from discovery to post-stay. An increased level of engagement not only results in more satisfied guests but also helps to increase revenue via upsells and add-ons and streamlines operations through automation.

With guest engagement tools, lodging operations can connect with guests at every touchpoint, including:

- Discovery. Utilize Livechat to answer traveler questions and move them to book at a faster rate.

- Pre-arrival. Send pre-arrival communication via SMS, WhatsApp, or Messenger to get guests excited about their stay, offer upsells or add-ons, and answer any questions.

- Arrival. Provide contactless check-in options and streamline the process with digital registration cards, key codes, and e-signatures to save your staff time and ensure guests can get started with their vacation as fast as possible.

- In-stay. Use automation to have your team quickly work through guest requests and catch any service issues while guests are still on property.

- Post-stay. Manage, respond to, and track guest’ reviews in real-time and send automated messages to capture guest feedback.

9. Robust integrations

The final feature of a well-rounded and powerful hotel management software is the ability to connect with third-party integrations. Integrations are tools and services that you can link to your HMS to get specific jobs done. For example, if you have a restaurant or cafe at your property, you could link a point of sale (POS) system to your hotel management software so your guests can easily charge purchases to their rooms.

Look for a hotel management software vendor that easily connects to your preferred third-party solutions. This integrations-friendly approach is a sign that the software provider wants to empower its customers.

The end result of any hotel management software has to be relationship-building. It’s all about empowering hoteliers with strong and user-friendly technology in order to free up time to build more personal interactions with guests.

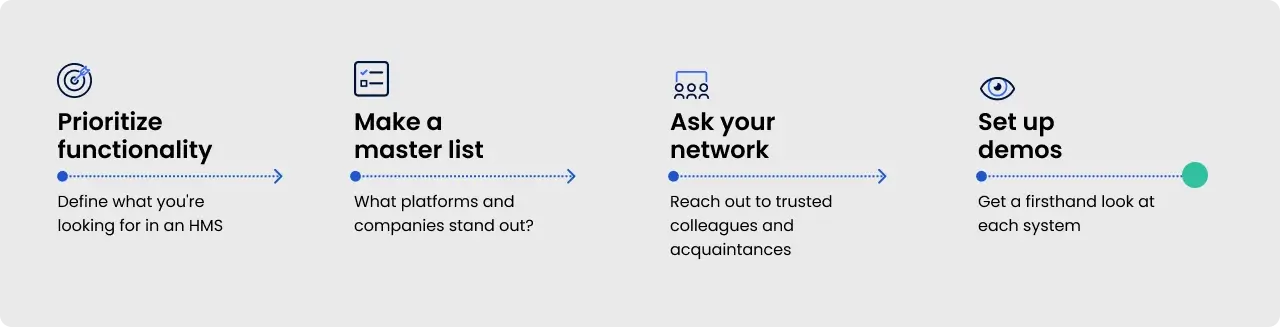

Evaluating HMS solutions

When selecting a new hotel management software solution, the process should be considered with patience and care. A lot is riding on this decision: as the hub of your property, your HMS plays a pivotal role in successful operations. Here are some critical steps when evaluating software solutions.

- Prioritize functionality. Before starting to research vendors, take the time to prioritize the functionality you’re looking for. Depending on your property type, you’ll require different functionality. Vacation rentals, for example, need more automation since they usually operate without front desk staff. To start, list your top three priorities by the level of importance. Most likely, you won’t find a provider that covers 100% of your hotel management software needs, but if you begin by identifying your must-have features, you’ll be able to evaluate your options with a more critical eye.

- Make a master list. Start researching. Drop your keyword, such as “hotel management software,” into a search engine to see what comes up in both paid ads and organic results. You can also review hospitality tech conference websites to see which companies are exhibiting at trade shows. Leverage unbiased reviews on reputable sites, like Capterra or Hotel Tech Report, to learn firsthand which tools are recommended – and by whom.

- Ask your network. Once you have your list of software options, you can start asking around your hospitality connections to hear first-hand experiences from colleagues and acquaintances about the vendors and tech tools on your list. You may discover patterns that can inform your decisions: a vendor with repeated positive feedback may move up the list, while one with more negative feedback may need to be crossed off.

- Set up demos. When you’ve narrowed down your list of favorites, get a firsthand look at the software by setting up demos. Be diligent in selecting your top 3-5 options to explore further. You can always expand your search once again if the demos disappoint.

For some, Step 4 is the most unpleasant part of the process. However, rushing through the software demo stage can lead to false assumptions and unrealistic expectations. Take your time during this phase, and really get to know the software companies under consideration. This is a long-term relationship and there’s no need to rush into something that may not be the best fit for your property.

To guide you in your selection of the right hotel management software, we’ve suggested a few questions to ask each vendor during the demo process.

How often do you roll out product updates?

Why it matters: Older systems that use locally installed hardware have the disadvantage of infrequent software updates and limited availability for customization. Newer hotel management software is often cloud-based, meaning the system will have software updates and upgrades done automatically without needing a specialized property visit from a technician. The hospitality industry is constantly changing, so software that can easily keep pace with industry demands will better support your hotel business in the long run. If the software is missing a feature you’d like to have, ask if that feature is on the product roadmap. As mentioned, no software is likely to have 100% of the features you want, but modern HMS is always evolving and improving to meet the needs of its customers.

How customizable is your system? Do you integrate with other software tools I use?

Why it matters: Every property is different, and each business has its own needs. That’s why it’s so important for hotel management software to be flexible and customizable. Even when selecting a hotel management suite that meets most of your needs, you want to know the flexibility you have to plug in other solutions over time as your business grows and evolves.

What training and ongoing support do you provide?

Why it matters: Switching from one system to another or implementing an entirely new one altogether is daunting. You’ll have to transfer reservations, get familiar with the system, and train your staff. Look for a software provider that will diligently work with you to help you get onboarded. Some may even offer a dedicated onboarding specialist to help you with personalized training. After your initial setup, consider what support is available to help you with any questions, like a library of knowledge base articles, training videos, and access to a support team.

How do you ensure data security?

Why it matters: Data hackers are a real threat to any business. For all of its tremendous benefits, cloud-based software can be more sensitive to security breaches. Talk to your software vendor about their security measures to keep your and your guests’ data safe. Some software may even feature different user-based permissions to keep sensitive data visible to only a few specific users.

Do you have case studies and references?

Why it matters: References can offer first-hand perspectives of what it’s like to work with the vendor and software system. A case study of a property similar to yours could help reveal the potential benefits of working with the provider. You may also want to request additional references to get a well-rounded perspective from fellow hotels in the business.

What different tools are included?

Why it matters: As you already may know, running an independent hotel takes a lot of work. You may not have the budget to hire specialized staff positions like a revenue manager or marketing professional. Hotel management software that offers a versatile toolset to optimize hotel operations will provide you with a lot more than just a property management system, channel manager, and booking engine.

What’s your customer service philosophy?

Why it matters: If you become a customer, you’ll want to know what to expect from your software provider if you have an issue with the system. It’s a good sign when a company has taken the time to provide 24/7 support in multiple languages across different channels (ie. live chat and email). It demonstrates a commitment to the customer – and an understanding that a product is only as good as the people supporting it.

What is your average onboarding time?

Why it matters: Onboarding any new software takes time. For larger properties, the training period can be a bit longer. By asking about the average onboarding time for properties of your size, you can set a realistic benchmark for yourself.

What happens if I’m not happy in the first 30 days?

Why it matters: You need the confidence of the guarantee. If the vendor doesn’t have confidence in its own product, why should you? Be sure to evaluate your software provider’s cancellation policy because you don’t want to be stuck with a flawed system and a company that will make you jump through hoops to leave.

Top 10 hotel management software providers

So, you have your requirements defined and your questions ready. The next step is to evaluate solutions. Here we’ve compiled 10 of the best hotel management systems on the market that you should consider in your search.

1. The Cloudbeds Hospitality Platform

Cloudbeds is the winner of the 2023 HotelTechAward for Best Hotel Management Software, along with five other accolades. The Cloudbeds Hospitality Platform enables tens of thousands of lodging businesses in more than 150 countries worldwide to grow and thrive. The platform is unified, modern, and intuitive and is enhanced by a comprehensive marketplace of third-party integrations. It streamlines operations, optimizes revenue, delights guests, and provides valuable insights for independent hoteliers.

2. Little Hotelier

Founded in 2012, Little Hotelier is an all-in-one hotel management system designed for small accommodation providers. Based in Sydney, Australia, the company helps over 9,000 properties worldwide and has been named the #2 Best Hotel Management System by 2023 HotelTechAwards. Little Hotelier is powered by Siteminder, offering a platform that is simple, easy to set up, and provides 24/7 customer support.

3. RoomRaccoon

RoomRaccoon is an all-in-one cloud-based software made for independent hotels, B&Bs, and apartments, founded in 2017 and based in the Netherlands. With over 1,500 clients around the world, it has been nominated as a finalist in Hotel Tech Report’s “Best Hotel Management System” category in the 2023 HotelTechAwards.

4. ResNexus

With over 3,200 customers worldwide, ResNexus is an all-in-one, cloud-based property management software for lodging businesses of all shapes and sizes. Launched in 2004 and based in the US, the company earned Hotel Tech Report’s level III Global Customer Support Certification (GCSC) in 2022.

5. ThinkReservations

Founded in 2012 and based in the US, ThinkReservations helps over 1,800 businesses mainly in North America. Their software includes an all-in-one property management system, online booking engine, and channel manager, with a customer satisfaction rate of 4.9/5 on Capterra.

6. WebRezPro

Trusted by over 2,000 accommodation providers in 45 countries, WebRezPro offers an all-in-one hospitality software organized into three main departments: front desk, back office, and accounting. Founded in 2003 and headquartered in Canada, the company has been named one of the top 10 Best Places to Work in Hotel Tech by the 2022 HotelTechAwards.

7. RMS

Headquartered in the US, RMS delivers a cloud technology trusted by more than 7,000 properties across 70 countries, also rated Top 5 PMS Systems on Hotel Tech Report. With over 35 years of experience, RMS Cloud offers a fully integrated property management solution to run a hospitality business from anywhere, at any time, and from any device.

8. innRoad

innRoad is an award-winning hotel management software that’s trusted by thousands of hotels around the world. Designed specifically for independent hoteliers, the company was founded in 2007, and it’s based in New York, US. Their fully integrated suite serves all property types, sizes, and experience levels.

9. eviivo

Launched in 2011 and headquartered in the UK, eviivo provides an integrated cloud-based property management software used by 20,000 independent properties. Recently, the company earned the Best Hotel Property Management Platform 2022 by Tech Times and it allows property owners, hoteliers, and hosts to manage guests, bookings, and online travel agencies in one single platform.

10. InnQuest

Founded in 2014 in Florida, US, InnQuest is used by more than 5,500 hospitality industry properties in over 100 countries. The technology provider for the hospitality business recently earned a Certification of Excellence from Hotel Tech Report, developing a comprehensive solution with a Hotel PMS, Channel Manager, Hotel CRM, and others to maximize the guest experience.

Getting started with your hotel management system

Congratulations! You’ve selected a hotel management system. Now that the big decision has been made, it’s time to focus on implementation. Ideally, you’ve already socialized the new tool with your team, so this process is less about introducing the new solution and more about adjusting workflows.

Implementation starts with an honest appraisal of current operations: where are the existing bottlenecks? What do you hope to get out of the software? Who are the designated internal advocates? How will we assess the success of this new software tool? Let these answers shape your approach to fully leveraging the power of your hotel management software.

We’ve spent years building and refining our hotel management software and have a deep well of past experiences to match the best implementation approach to each client. From getting started to maintaining momentum, here’s how to get the most out of your new platform.

Set your rates

Setting rates is one of the more complex tasks that hoteliers regularly face. Careful analysis of your property’s performance and fluctuations in local market demand can help you find the right price.

Consider setting a rate plan in your hotel management system to streamline this process. That way, several OTA channels can base their pricing on your established rate plan. Then you can adjust rates on individual channels via the extranet to take advantage of any channel-specific pricing tools.

Another option is to set a channel-specific difference. This allows you to adjust the pricing of each room type by a set amount or percentage on that channel – without having to log into the extranet. The system will simply take the base rate and then add (or subtract) accordingly.

Every time you update your base rates, the prices will adjust according to these settings, giving you more dynamic rate control without having to do rate management on multiple channels individually. As with most distribution and revenue management aspects, revisit rates regularly to monitor for accuracy and consistency. You may also consider using a revenue management tool to help you select the best rates for your property based on local events and your competitors.

Map your inventory

One of the biggest mistakes hotels can make when onboarding new software is inaccurate room mapping: identifying and connecting your property’s room types to your third-party distribution channels or OTAs. Accurately mapping your room names, descriptions, features, and amenities means that they are displayed the same across channels. This practice ensures that your rooms are primed for conversion and help avoid confusion when guests make comparisons across different channels – plus, it helps with SEO and streamlines your own revenue management efforts.

The mapping process can get quite complicated, as rooms must match across your channel manager, property management system, and third-party distribution channels. But it’s important: improperly mapped inventory can lead to overbookings, lost reservations, and other miscommunications.

The ideal approach is to practice one-to-one mapping, which maps one room type in an OTA to one room type in your HMS. We recommend focusing on room types rather than individual rooms to achieve this.

Some distribution platforms, such as Expedia, require room types. Others, such as Airbnb, allow individual rooms. If your property is a bed-and-breakfast with unique rooms, it’s still preferable to use room types – unless you plan never to use the major distribution channels. The mapping process can be a pain, so if you ever think you might distribute inventory elsewhere, use room types to future-proof your mapping.

Connect your channels

Once you’ve set up your rates and finished mapping, it’s time to connect your channels. Remember that each distribution channel requires its own account, and most hotel management software won’t sign up on your behalf. Choose your desired distribution channels, make individual accounts, and then return to your HMS to connect those channels.

Automate your communications

Guest communication is one of the most powerful tools within your hotel management software. How you communicate with past and future guests sets the tone for the relationship and your guests’ level of satisfaction.

To properly automate guest communications, focus on these areas as a starting point:

- Confirmation email: Ensure that you automatically send a confirmation email for each booking; never do this manually! Guests expect instant confirmations and want to know that their chosen hotel is responsive, organized, and legitimate.

- Pre-arrival email: A few days before a guest arrives, send a “we look forward to welcoming you” email. This message can include important details of their upcoming stay (thus reducing calls to the front desk), including destination information and special offers for on-property amenities. It’s a valuable touchpoint because guests are most likely to be thinking about their upcoming trip.

- Post-stay email: In today’s digital economy, reviews are gold! An email requesting feedback and reviews encourages guests to share their experiences. There’s also an opportunity to identify potential problems before they end up online.

Once you’ve set up these basic touchpoints, consider what you want your guest engagement strategy to look like. Based on your target demographics, does it make sense for you to send messages via SMS or messenger? How can you earn incremental revenue through upsells? An HMS with guest engagement functionality can help you become more sophisticated in your communication strategy.

Build out your direct booking strategy

A comprehensive hotel management system should include a commission-free booking engine to serve as your direct booking channel. To get the most out of your hotel management software, take the time to integrate your booking engine into your hotel website and customize it to match your site’s design.

If applicable, take advantage of your HMS provider’s expertise and see if they can help you to build an eCommerce-optimized website to help drive more traffic and increase conversion rates.

To further increase visibility, consider other marketing channels like metasearch advertising, retargeting ads, and optimized business listings. Always reach out to your provider to see if they have any suggestions on optimizing your digital marketing efforts – they work with hundreds of properties and have a good idea of what works best for lodging operators.

The Vaquero Motel in Bandera, Texas, was attracted to the Cloudbeds Hospitality Platform because of the toolkit it offered, which he referred to as a “one-stop shop” with a PMS, payments processor, website, and digital marketing solution.

Owner, Carlos Gonzalez, worked with Cloudbeds to streamline operations and grow the motel’s online presence. Using Cloudbeds’ team of digital marketing experts, The Vaquero Motel implemented an SEO-enhanced and fully integrated website with a mobile-friendly booking engine and metasearch advertising across platforms like Tripadvisor, Google Hotel Ads, and Trivago. This effort has resulted in a 5X ROI on marketing spend with increased brand awareness leading to a more robust direct booking strategy.

Train your staff

Training is the most time-intensive part of this process. It’s also one of the behaviors that define top-performing properties: those who prioritize training unlock greater value from their hotel management software.

In addition to upfront implementation, don’t neglect ongoing training. It’s not always feasible or realistic to train staff on every last detail at the outset. Start with the essential things people need to know for their day-to-day, and then gradually introduce new features as appropriate.

It may be beneficial to develop a process for training that can be repeated as needed. If your hotel management software is user-friendly and built for ease of use, the training process will be much easier.

Integrate with purpose

The best hotel management software integrates with various platforms, tools, and services. As you move beyond setting up the essentials, such as inventory allocation, rates, and channels, you’ll want to focus on integrations.

Start with the integrations that fulfill a need or are most valuable to you. Maybe you need more robust accounting capabilities or want to implement keyless entry at your property. The good news is that with modern hotel management software, you can customize your system and tools to your liking.

Maintain momentum

Finally, maintain momentum. Hotel management software isn’t a “set it and forget it” thing. It’s an ally that can become a valuable asset in building a profitable hospitality business. Consult your metrics often, and adjust areas that seem to be underperforming your expectations. A steady approach leads to consistent results – and that’s how you get the most out of your hotel management software!

Making the switch to a modern HMS solution

Adopting a modern, cloud-based HMS solution is a game-changer for independent properties. With automatic updates, new features, and everything you need in one platform, you’ll not only save everyone on your team time but increase revenue and deliver better guest experiences.

The Cloudbeds Hospitality Platform offers lodging businesses of all sizes a powerful, intuitive, and unified solution that includes everything you need to run your property. The core platform consists of an award-winning PMS, channel manager, and booking engine with additional tools to increase revenue, delight guests and streamline day-to-day operations, including a pricing intelligence engine, digital marketing service, guest engagement functionality, a robust integration marketplace, secure payment solution, and open-API.

The opportunities are endless with Cloudbeds, and our team is here every step of the way. From a dedicated onboarding coach to hundreds of training videos in Cloudbeds University, we’re committed to ensuring that you and your entire team are using the system to its full advantage.